Understanding Tokenomics for Smart Investing Made Easy

Understanding Tokenomics for Smart Investing opens up a fascinating realm where the complexities of cryptocurrency are simplified for savvy investors. As the digital economy continues to evolve, grasping the underlying principles of tokenomics becomes essential for making informed investment decisions. This exploration delves into the dynamics of token types, economic models, governance, and market sentiment—equipping you with the tools to navigate this innovative landscape.

From deciphering the various types of tokens to understanding how token supply and distribution influences market value, we’ll break down the essentials you need to know. With insights into risks and emerging trends, this guide is your roadmap to leveraging tokenomics for smarter investment strategies.

Introduction to Tokenomics

Source: rmckinley.net

Tokenomics is a portmanteau of “token” and “economics,” and it refers to the study of the economic structure of tokens, primarily in the realm of cryptocurrencies. It encompasses the various mechanisms that govern the creation, distribution, and management of tokens, which play a crucial role in the functionality of blockchain networks. Understanding tokenomics is essential for any investor looking to navigate the intricate landscape of cryptocurrencies, as it not only influences the value of tokens but also impacts the overall health and sustainability of the blockchain ecosystem.

The relationship between tokenomics and smart investing is inherently intertwined. Investors who grasp tokenomics can make informed decisions, strategically assessing the potential of a project based on its token model. This understanding aids investors in identifying opportunities that are not just valuable in terms of their current price but also in their long-term viability. A well-structured tokenomics model fosters incentives for participation and ensures the project’s growth and development, making it a vital consideration for prospective investors.

Components of Tokenomics

Diving into the components that make up tokenomics reveals a complex yet fascinating landscape. Each aspect contributes to the functionality and appeal of a token within its ecosystem. The main components include:

- Supply: The total number of tokens available plays a pivotal role in determining scarcity and value. Tokens can be pre-mined, minted, or released over time through mining or staking mechanisms.

- Distribution: How tokens are distributed affects market dynamics. Distribution methods can include Initial Coin Offerings (ICOs), airdrops, and continuous rewards for active users in the ecosystem.

- Utility: The purpose of the token within its ecosystem defines its value. Utility tokens may provide access to services, voting rights in governance, or incentives for network participation.

- Incentive Structures: These are designed to motivate behaviors that support the network. This includes rewards for validating transactions or penalties for malicious activities.

- Market Dynamics: Factors such as liquidity, trading volume, and market sentiment are crucial in understanding how a token performs in the broader market.

“Understanding tokenomics is not just about the numbers; it’s about grasping the underlying motivations and mechanics that drive the value of tokens in the ever-evolving cryptocurrency landscape.”

Types of Tokens

In the rapidly evolving world of cryptocurrencies and blockchain technology, understanding the various types of tokens is essential for smart investing. Tokens can serve multiple purposes, from enabling utility within platforms to representing ownership in a project. Recognizing these distinctions not only enhances investment strategies but also empowers investors to align their portfolios with their goals and risk appetites.Tokens are primarily classified into several categories, each with its own unique characteristics and use cases.

These can be broadly defined as utility tokens, security tokens, governance tokens, and more. Each type serves different functions within the ecosystem, influencing their value propositions and investment strategies.

Utility Tokens

Utility tokens are designed to provide users with access to a specific product or service within a blockchain ecosystem. They are integral to the operation of a platform and typically facilitate transactions within that environment. Examples of successful utility tokens include:

- Ethereum (ETH): Serves as the backbone of decentralized applications (dApps) and smart contracts.

- Binance Coin (BNB): Used within the Binance exchange for trading fee discounts and other functionalities.

- Chainlink (LINK): Enables smart contracts to access off-chain data feeds, APIs, and payment systems.

The primary use case for utility tokens in smart investing is their ability to grant holders access to network services, which can translate to financial gain as the underlying platform grows in usage and value.

Security Tokens

Security tokens represent ownership or a stake in an underlying asset, such as real estate or company equity. They are subject to federal regulations and offer investors legal protections, akin to traditional securities.Notable examples of security tokens include:

- tZERO: A platform providing technology for the trading and issuance of security tokens.

- Harbor: Facilitates compliant tokenization of real estate assets.

- Polymath: A platform that enables the creation and management of security tokens.

Investors view security tokens as a way to diversify their portfolios with tangible assets and potentially benefit from regulated investment opportunities.

Governance Tokens

Governance tokens empower holders to participate in the decision-making process of a decentralized network. These tokens allow users to propose and vote on changes to protocols, making them central to the democratic governance of blockchain projects.Examples of successful governance tokens include:

- Uniswap (UNI): Holders can vote on protocol upgrades and community initiatives.

- Maker (MKR): Enables holders to influence the governance of the MakerDAO ecosystem.

- Compound (COMP): Gives users a voice in making decisions regarding the lending protocol.

Governance tokens appeal to investors who wish to have an active role in shaping the future of the projects they support, adding an additional layer of strategic involvement in their investment decisions.

Other Token Types

Apart from utility, security, and governance tokens, there are several other types worth mentioning, including stablecoins and non-fungible tokens (NFTs). Stablecoins are pegged to traditional fiat currencies, providing a stable value that is less susceptible to market volatility. Examples include:

- Tether (USDT): Pegged to the US Dollar, widely used for trading.

- USD Coin (USDC): Another dollar-pegged stablecoin, known for its transparency and regulation compliance.

Non-fungible tokens (NFTs) represent unique digital assets, often associated with art, collectibles, and gaming items. They have revolutionized ownership rights in the digital world, allowing creators to monetize their work directly. Examples include:

- CryptoPunks: One of the first NFT projects on Ethereum, featuring unique pixel art characters.

- Bored Ape Yacht Club: A collection of unique digital apes that grants owners access to exclusive events and club memberships.

Understanding these various tokens and their respective use cases fosters informed decision-making in smart investing. Recognizing the potential and risks associated with each type can significantly impact investment outcomes and overall portfolio performance.

Economic Models in Tokenomics

Economic models play an essential role in tokenomics as they dictate how tokens are distributed, utilized, and valued in various ecosystems. Understanding these models can help investors make informed decisions and strategize effectively. There are primarily two common economic models prevalent in tokenomics: inflationary and deflationary models. Each of these models has its implications on token value and investor behavior.

Inflationary Economic Models

Inflationary models allow for the continuous creation of tokens over time. This can lead to a gradual increase in the total supply, which can cause dilution of value if demand does not keep pace. However, inflation can be beneficial in stimulating usage and adoption of the token within its ecosystem.

- Ethereum: Originally designed with an inflationary model, Ethereum produces new tokens as rewards for miners. This model incentivizes network security and transaction validation.

- Dogecoin: This meme-based cryptocurrency has an unlimited supply, issuing new tokens regularly. Its inflationary model encourages spending rather than hoarding, fostering a community-driven approach.

Deflationary Economic Models

In contrast, deflationary models limit the supply of tokens, often through mechanisms such as buybacks or token burns. This scarcity can increase the value over time, assuming demand remains steady or increases.

- Bitcoin: Bitcoin operates on a deflationary model with a capped supply of 21 million coins. As more people adopt Bitcoin, the limited supply creates upward pressure on its value.

- Binance Coin (BNB): Binance uses a token burn mechanism to reduce the total supply of BNB, intending to increase scarcity and drive up value over time.

Impact on Token Value and Investor Strategy

The choice of economic model directly impacts token valuation and the strategies that investors may deploy. Inflationary models generally encourage active participation within the ecosystem, while deflationary models may attract long-term holders looking for value appreciation.

- In inflationary environments, investors might focus on short-term gains, capitalizing on the liquidity provided by new tokens.

- In deflationary scenarios, investors often adopt a buy-and-hold strategy, anticipating price increases due to limited supply.

“Understanding whether a token operates under an inflationary or deflationary model is crucial for developing effective investment strategies.”

In summary, the economic model a token follows can greatly influence its market dynamics and the strategies investors choose. Familiarity with these models helps navigate the evolving landscape of tokenomics.

Token Supply and Distribution

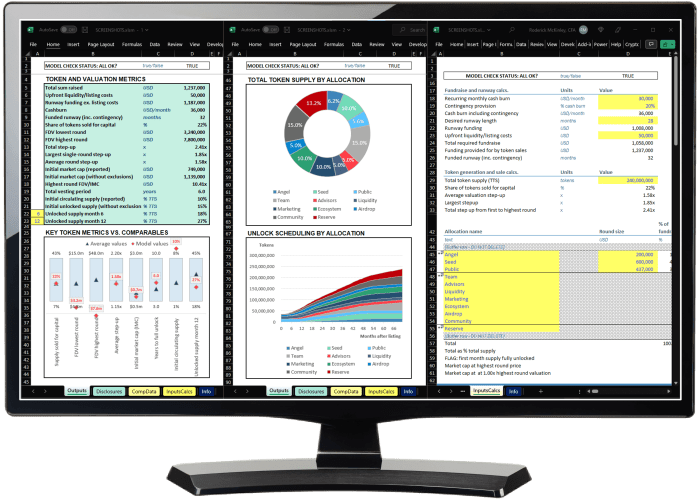

Source: bitbond.com

Token supply and distribution are crucial components in understanding the value of a cryptocurrency and its potential for investment. The supply of tokens can significantly impact price, liquidity, and market sentiment, making it essential for investors to assess these factors when making investment decisions. A well-structured token economy can determine the long-term viability of a project, influencing how investors approach their strategies.Token supply can be categorized into two main types: fixed and variable.

Fixed supply tokens have a predetermined maximum number of coins that will ever be created, such as Bitcoin. This scarcity can drive demand and value over time. In contrast, variable supply tokens can be minted or burned based on various factors, which can lead to inflation or deflation depending on the governing economic model. Understanding the implications of these supply types helps investors gauge potential price movements and overall market behavior.

Methods for Analyzing Token Distribution

Analyzing token distribution provides insights into how tokens are allocated, which can affect performance and investor sentiment. Different methods of distribution include Initial Coin Offerings (ICOs), Initial DEX Offerings (IDOs), and airdrops. Each method has different implications for token ownership and market dynamics.

- Initial Coin Offerings (ICOs) are fundraising methods where a project sells its tokens to early investors before the official launch. The distribution strategy here can impact the initial price and market demand.

- Initial DEX Offerings (IDOs) occur on decentralized exchanges and allow users to purchase tokens directly, often leading to more democratized access for investors.

- Airdrops involve distributing free tokens to existing holders or potential users, usually as a marketing strategy. This can create buzz and increase the user base quickly.

Understanding these distribution methods is essential for evaluating a project’s potential. Below is a comparative table illustrating the token supply and distribution strategies of various projects.

| Project | Token Supply Type | Distribution Method | Initial Supply | Key Features |

|---|---|---|---|---|

| Bitcoin | Fixed | Mining | 21 million | Decentralized, deflationary |

| Ethereum | Variable | ICO | Initial supply of 60 million | Smart contracts, platform for DApps |

| Cardano | Fixed | ICO | 45 billion | Proof of stake, scalability focus |

| Uniswap (UNI) | Fixed | Airdrop | 1 billion | Governance token, decentralized exchange |

By examining the token supply and distribution strategies of different projects, investors can gain valuable insights into potential risks and rewards. Keeping track of these elements allows for informed decisions in the rapidly evolving crypto landscape.

Governance and Community Involvement

In the evolving landscape of tokenomics, governance plays a pivotal role in shaping the decision-making processes that influence the future of blockchain projects. Governance mechanisms determine how a token-based ecosystem operates and how stakeholders can engage in the management and direction of the project. Smart investors recognize that effective governance can lead to enhanced transparency, greater community trust, and ultimately, a more robust investment environment.The governance structure in tokenomics often involves various models, including on-chain governance and off-chain governance.

On-chain governance allows token holders to vote directly on proposals and changes, making the process more democratic and transparent. Off-chain governance, on the other hand, may involve discussions in forums, social media, or other platforms where community members can express their opinions and influence decisions. This participatory approach can significantly impact the long-term success of the project, as community members feel a sense of ownership and responsibility.

Examples of Community-Driven Projects

Several notable projects exemplify successful community-driven governance models, showcasing different approaches to decision-making. These examples illustrate the diverse ways communities can engage and influence the direction of a project.

- MakerDAO: MakerDAO operates on a decentralized governance model where MKR token holders vote on key aspects such as stability fees and collateral types. This allows the community to adapt the system to changing market conditions, fostering resilience and innovation.

- Tezos: Tezos employs a unique self-amending governance mechanism that allows stakeholders to propose and vote on protocol upgrades. This continuous evolution helps ensure that the network adapts to new technological advancements and community needs.

- Aragon: Aragon provides tools for creating and managing decentralized organizations. Its governance structure allows communities to create their own rules and decision-making processes, empowering them to tailor their governance according to specific needs.

The success of these projects can be attributed to their strong community involvement, which fosters a sense of belonging and shared purpose among participants.

Benefits and Challenges of Community Involvement

Community involvement in token-based projects presents both advantages and challenges that can significantly impact governance and investment outcomes.The benefits of community involvement include:

- Increased Transparency: Engaging the community in governance leads to more transparent decision-making processes.

- Diverse Perspectives: A broader base of participants results in a variety of viewpoints, helping to identify potential issues and innovative solutions.

- Enhanced Loyalty: When community members have a say in governance, their commitment to the project strengthens, fostering a loyal user base.

Despite these advantages, there are also challenges that can arise:

- Decision-Making Delays: Consensus-driven governance can slow down the decision-making process, potentially hindering responsiveness in dynamic markets.

- Voter Apathy: Not all token holders will actively participate in governance, which can lead to skewed decision-making based on a minority of active participants.

- Conflict of Interests: Differing opinions within the community can result in conflicts, making it difficult to reach a consensus on important issues.

Understanding these dynamics is crucial for smart investors, as they can influence both the short- and long-term viability of token-based projects. By recognizing the role of governance and community involvement, investors can make more informed decisions in the tokenomics space.

Market Sentiment and Behavior

Market sentiment plays a pivotal role in the cryptocurrency landscape, influencing both token values and the strategies employed by investors. The perception of market conditions, driven by emotions and external events, can lead to significant fluctuations in token prices. Understanding market sentiment enables investors to navigate the volatile nature of the cryptocurrency market more effectively.Market sentiment is not just about the current mood of investors; it reflects broader economic indicators, social media trends, and news cycles.

As such, gauging sentiment can offer insights into potential price movements and help shape investment decisions. Investors often utilize various tools and metrics to measure sentiment, giving them a competitive edge in their trading strategies.

Factors Influencing Market Sentiment in Cryptocurrency

Several factors can significantly impact market sentiment within the cryptocurrency space. Recognizing these factors is essential for investors looking to interpret market movements accurately. Below is a list of key elements that can sway sentiment:

- News and Announcements: Major developments, regulatory news, or endorsements from influential figures can shift sentiment rapidly.

- Market Trends: Bull or bear trends in the market can create a herd mentality, influencing investor behavior.

- Social Media Activity: Platforms like Twitter and Reddit play a crucial role in shaping public opinion and can lead to rapid price changes.

- Technical Indicators: Metrics such as trading volume and price charts can inform investor sentiment and predict future movements.

- Investor Sentiment Surveys: Polls and surveys can provide a snapshot of investor confidence or fear, helping to gauge market mood.

- Influencer Opinions: Insights or predictions from respected figures in the crypto space can sway market sentiment significantly.

- Global Economic Conditions: Macroeconomic factors, including inflation rates and economic stability, can influence the overall demand for cryptocurrencies.

- Technological Developments: Innovations in blockchain technology or changes to existing protocols can impact investor confidence.

Understanding these factors allows investors to better anticipate market movements and refine their strategies in response to changing sentiment.

“Market sentiment is the key to understanding price movements in the cryptocurrency world.”

By analyzing these influences, investors can make informed decisions that align with current market behavior, maximizing their potential for success in a highly dynamic environment.

Risks and Challenges in Tokenomics

Source: tastycrypto.com

Investing in tokens can be an enticing opportunity, but it’s essential to navigate the landscape of tokenomics with a clear understanding of the inherent risks and challenges. While the potential for high returns is significant, token investments also carry unique risks that can result in substantial losses or regulatory hurdles. This section delves into common risks associated with token investments, strategies to mitigate them, and the regulatory challenges impacting the tokenomics space.

Common Risks in Token Investments

Investors should be aware of several common risks when considering token investments. These risks can stem from market volatility, technological issues, and the overall regulatory environment. Understanding these risks allows investors to make informed decisions and implement strategies to mitigate their impact.

- Market Volatility: The cryptocurrency market is known for its high volatility, with token prices subject to rapid fluctuations. Sudden market shifts can lead to significant losses.

- Technological Risks: Bugs or vulnerabilities in smart contracts or underlying blockchain technology can expose investors to security threats and loss of funds.

- Regulatory Risks: Changes in regulations or legal frameworks surrounding token sales and cryptocurrencies can impact token value and investor rights.

- Lack of Transparency: Some projects may lack clear communication regarding their business model or token utility, making it difficult for investors to assess potential risks.

- Liquidity Risks: Certain tokens may have low trading volumes, making it challenging to buy or sell without impacting their price significantly.

Strategies to Mitigate Risks, Understanding Tokenomics for Smart Investing

To enhance the safety of token investments, various strategies can be implemented. Investors can protect their capital by adopting best practices rooted in research and prudent decision-making.

- Diversification: Spreading investments across multiple tokens can reduce exposure to any single asset’s volatility.

- Conducting Due Diligence: Thoroughly researching projects, including their team, technology, and market potential, can help identify potential red flags.

- Using Secure Wallets: Storing tokens in secure wallets instead of exchanges can safeguard assets against hacks.

- Setting Realistic Goals: Establishing clear investment goals and exit strategies can help manage emotions during market fluctuations.

- Monitoring Regulatory Developments: Staying informed about changes in regulations can help investors adapt their strategies accordingly.

Regulatory Challenges Impacting Tokenomics

The evolving regulatory landscape significantly affects tokenomics, influencing investment potential and market dynamics. Various jurisdictions are implementing regulations that can either foster innovation or stifle growth.

- Uncertain Regulatory Environment: The lack of clear regulatory guidelines can create uncertainty for investors and project developers, affecting investment confidence.

- Compliance Costs: Complying with regulations can impose high costs on token projects, impacting their profitability and sustainability.

- Legal Classification of Tokens: The classification of tokens as securities or utility tokens can have profound implications on how they are regulated and marketed.

- International Disparities: Different regulatory approaches across countries can create challenges for projects operating in multiple jurisdictions.

Lessons Learned from Past Token Failures

Examining past token failures provides valuable lessons for investors and developers. Understanding these cases can help identify warning signs and improve future decision-making.

- The DAO Incident (2016): A smart contract vulnerability led to a significant hack, resulting in the loss of approximately $60 million worth of Ether. This incident highlighted the importance of secure coding practices and risk assessments.

- BitConnect (2017): Marketed as a high-yield investment platform, BitConnect turned out to be a Ponzi scheme, resulting in substantial losses for investors. The case emphasizes the need for skepticism towards unrealistic returns.

- OneCoin (2014-2017): Promoted as a cryptocurrency, OneCoin was a fraudulent scheme that defrauded investors of billions. This illustrates the importance of verifying the legitimacy of projects before investing.

- Centra Tech (2017): The founders were charged with fraud for misleading investors about their partnerships and technology. This case underscores the importance of transparency in project disclosures.

Future Trends in Tokenomics: Understanding Tokenomics For Smart Investing

As the landscape of blockchain technology continues to evolve, so too does the field of tokenomics. Investors must stay informed about emerging trends that could significantly impact their strategies and the overall market dynamics. These trends are driven by advancements in technology, changes in regulatory environments, and shifts in market sentiment.A close examination of the current developments highlights several key trends in tokenomics that promise to reshape the investment landscape.

Understanding these trends can help investors make informed decisions and harness potential opportunities for growth.

Emerging Trends in Tokenomics

The following trends represent pivotal changes in the tokenomics landscape, which can influence investment strategies and market behavior:

- Decentralized Finance (DeFi): The rise of DeFi platforms is fundamentally altering how financial services are offered, allowing users to lend, borrow, and trade cryptocurrencies without intermediaries. This shift increases accessibility and potentially reduces costs for investors.

- Non-Fungible Tokens (NFTs): NFTs are gaining traction beyond digital art and collectibles, entering sectors such as gaming, real estate, and even identity verification. Their unique utility and ownership structure are likely to attract new investors.

- Regenerative Finance (ReFi): This emerging sector focuses on creating positive environmental and social impacts while generating financial returns. Projects that prioritize sustainability may become increasingly popular among socially conscious investors.

- Tokenized Assets: The tokenization of physical assets, such as real estate and commodities, is creating new investment avenues. This trend offers fractional ownership and enhanced liquidity for traditionally illiquid assets, broadening the investment base.

- Layer 2 Solutions: Innovations like Layer 2 scaling solutions aim to enhance transaction speeds and reduce costs on existing blockchains. As these solutions mature, they could lead to increased adoption and use cases for tokens.

Implications for Investors

Investors need to understand how these trends can shape their investment decisions. By recognizing the potential of DeFi, NFTs, and tokenized assets, they can identify opportunities for diversification and growth.

“The future of tokenomics promises a blend of innovation and utility, where financial opportunities expand alongside technological advancements.”

Innovative Projects Reshaping Tokenomics

Many innovative projects are contributing to the transformation of tokenomics. The following table highlights some of the key players:

| Project Name | Description | Impact on Tokenomics |

|---|---|---|

| Uniswap | A decentralized exchange that allows users to trade cryptocurrencies directly without an intermediary. | Revamping liquidity provision and reducing trading costs for investors. |

| Axie Infinity | A blockchain-based game that incorporates NFTs and play-to-earn mechanics. | Creating a new economic model that attracts gamers and investors alike through asset ownership. |

| Chainlink | A decentralized oracle network that connects smart contracts to real-world data. | Enhancing the functionality of smart contracts and expanding their use cases. |

| Yield Protocol | A protocol for borrowing and lending stablecoins with a focus on yield optimization. | Increasing the efficiency of capital utilization in the DeFi space. |

| Polygon | A Layer 2 solution for Ethereum that enhances scalability and reduces transaction costs. | Facilitating a smoother and more efficient user experience, promoting broader token adoption. |

Last Word

In conclusion, mastering the fundamentals of tokenomics is crucial for anyone looking to invest wisely in the cryptocurrency space. By understanding the interplay between token types, economic models, and market behaviors, investors can position themselves to seize opportunities and mitigate risks. As the tokenomics landscape continues to evolve, staying informed will be the key to thriving in this exciting domain.

Questions and Answers

What is tokenomics?

Tokenomics refers to the study of the economic models and structures behind cryptocurrency tokens, including their creation, distribution, and utility.

Why is tokenomics important for investors?

Tokenomics helps investors assess the value, potential growth, and risks associated with different tokens, guiding smarter investment decisions.

How does governance impact token value?

Governance mechanisms can influence a token’s value by affecting how decisions are made within the project, impacting its development and market perception.

What are some common risks in token investments?

Common risks include market volatility, regulatory changes, and project failures, all of which can significantly impact the value of tokens.

How can I measure market sentiment related to tokens?

Market sentiment can be measured through social media trends, news analysis, and investor behavior, providing insights into potential price movements.