Understanding Market Cycles in Crypto Insightful Guide

Understanding Market Cycles in Crypto sets the stage for an intriguing exploration of how cryptocurrency markets ebb and flow. These cycles, characterized by phases of accumulation, uptrends, distribution, and downtrends, play a crucial role in shaping investor behavior and market trends. By breaking down these phases and analyzing historical patterns, traders can better navigate the complex world of crypto investing.

The study of market cycles not only unveils the historical context of cryptocurrency but also highlights the indicators and psychological aspects that influence trader decisions. Knowing how to identify and adapt to these cycles can empower investors to make informed trading choices and leverage opportunities effectively.

Introduction to Market Cycles

Source: medium.com

Market cycles are essential to understanding the ebb and flow of cryptocurrency prices. They represent the collective behavior of investors and traders as they react to various market stimuli, leading to distinct phases in asset valuation. Recognizing these cycles can empower participants to make informed decisions, capitalizing on potential investment opportunities while minimizing risks.The concept of market cycles can be broken down into four primary phases: accumulation, uptrend, distribution, and downtrend.

Each phase has unique characteristics that reflect market sentiment and trading activity. Understanding these phases provides valuable insights into market dynamics.

Characteristics of Market Cycle Phases

The different phases of market cycles illustrate the shifts in investor psychology and market behavior. Below is a table summarizing the essential characteristics of each phase:

| Phase | Description | Investor Behavior |

|---|---|---|

| Accumulation | Characterized by low prices as savvy investors begin to buy assets. | Investors exhibit cautious optimism, looking for long-term gains. |

| Uptrend | Prices rise significantly due to increased buying interest and positive sentiment. | Investors become increasingly enthusiastic, often leading to FOMO (Fear of Missing Out). |

| Distribution | Price levels peak as early adopters start taking profits, and market interest wanes. | Investors show mixed sentiment, with some looking to exit positions while others hold on. |

| Downtrend | Prices decline as selling pressure increases, often leading to panic. | Investors experience fear, leading many to sell and lock in losses. |

Understanding these phases can help investors identify market trends and make strategic decisions. For instance, recognizing the accumulation phase can signal a buying opportunity, while being aware of the distribution phase can suggest it might be time to take profits.

Historical Market Cycles in Crypto

Source: ueex.com

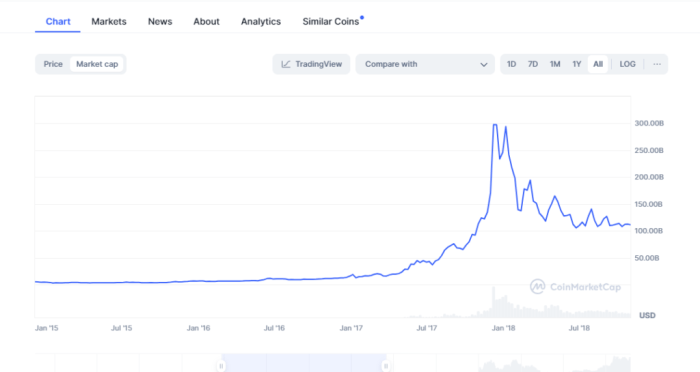

The cryptocurrency market has experienced several significant cycles since its inception, each shaped by distinct events and trends. Understanding these historical cycles can provide valuable insights into how the market behaves and reacts to various influences. By examining past cycles, we can better anticipate future movements and understand the broader market dynamics at play.

Market cycles in the cryptocurrency space have often been influenced by external factors such as regulatory changes, technological advancements, and macroeconomic trends. These cycles can be characterized by periods of rapid growth followed by sharp declines, creating a volatile yet fascinating ecosystem for investors and enthusiasts alike. Below, we explore some notable market cycles and the key events that have defined them.

Significant Market Cycles and Key Events

The following timeline highlights crucial events in the cryptocurrency market and their correlation with market cycles. Understanding these events helps illustrate how external factors can significantly impact market sentiment and price trends.

| Year | Event | Impact on Market Cycle |

|---|---|---|

| 2011 | First Major Price Surge | The price of Bitcoin surged from $1 to over $30, marking the beginning of mainstream interest. |

| 2013 | Bitcoin Reaches $1,000 | This surge was fueled by media attention and increased adoption, leading to a significant market rally. |

| 2014 | Mt. Gox Exchange Collapse | The collapse caused a massive sell-off, leading to a prolonged bear market that lasted over a year. |

| 2017 | ICO Boom and Bitcoin Hits $20,000 | The explosion of initial coin offerings (ICOs) led to extreme speculation and a subsequent market correction. |

| 2020 | DeFi Surge | The rise of decentralized finance (DeFi) projects brought renewed interest and investment, driving prices up. |

| 2021 | Bitcoin Reaches All-Time Highs | Institutional adoption and mainstream media coverage led to Bitcoin climbing to nearly $65,000. |

| 2022 | Regulatory Scrutiny Increases | Heightened regulatory scrutiny resulted in a market downturn, with Bitcoin falling below $20,000. |

The interplay of technological advancements, such as the introduction of smart contracts and improvements in blockchain technology, alongside regulatory developments, have been pivotal in shaping market cycles. For instance, the rise of DeFi platforms in 2020 significantly influenced the bullish sentiment, while increased regulation in 2022 contributed to a bearish trend.

Understanding these historical market cycles allows investors to recognize patterns and make informed decisions based on past events and their outcomes.

History often serves as a guide in navigating the unpredictable waters of cryptocurrency investment.

Indicators for Identifying Market Cycles

Understanding market cycles is crucial for traders, especially in the volatile world of cryptocurrency. Identifying these cycles can help traders make informed decisions about when to enter or exit positions. Various indicators assist in this task, each offering unique insights into market trends. Utilizing these tools effectively can greatly enhance a trader’s strategy, allowing them to capitalize on both upward and downward movements.To effectively identify market cycles, traders often rely on a combination of technical indicators.

These indicators provide valuable signals that can indicate potential trend reversals or continuations. Two of the most commonly used indicators are Moving Averages and the Relative Strength Index (RSI). Here, we’ll explore these indicators and how they can be integrated into trading strategies.

Moving Averages and RSI

Moving Averages smooth out price data to identify trends over a specific period. By calculating the average price over a set number of periods, traders can determine the overall direction of the market. The most popular types are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). The Relative Strength Index (RSI) measures the speed and change of price movements, providing insights into overbought or oversold conditions.

An RSI value above 70 typically indicates an overbought market, while a value below 30 indicates an oversold market. Applying these indicators involves observing crossovers and divergences. For instance, when the short-term moving average crosses above the long-term moving average, it may signal a bullish trend, while the opposite can indicate a bearish trend. Similarly, using RSI alongside price action can help confirm potential entries or exits.When integrating these indicators into trading strategies, traders often look for confluence, or overlapping signals, to increase the probability of successful trades.

Here’s a comparison table of various indicators including Moving Averages and RSI, outlining their strengths and weaknesses:

| Indicator | Strengths | Weaknesses |

|---|---|---|

| Moving Averages | Smooths out price data, helps identify trends, easy to understand | Lagging indicator, may give false signals in sideways markets |

| Relative Strength Index (RSI) | Indicates overbought/oversold conditions, helps identify reversals | Can produce false signals in strong trends, requires confirmation |

| Bollinger Bands | Visualizes volatility, identifies potential price reversals | Can be misleading during strong trends, requires additional confirmation |

| MACD (Moving Average Convergence Divergence) | Divergence and crossover signals can indicate momentum shifts | Lagging indicator, may produce whipsaws in choppy markets |

By understanding the strengths and weaknesses of these indicators, traders can better tailor their strategies to navigate the complex landscape of cryptocurrency trading. This awareness enhances their ability to make decisions aligned with current market cycles, improving their overall trading performance.

Psychological Aspects of Market Cycles

Understanding the psychological factors that drive traders’ behavior is crucial in navigating the volatile world of cryptocurrencies. Market cycles are not just influenced by economic factors; they are significantly shaped by human emotions and collective psychology. These elements influence decisions, which can lead to either rational strategies or irrational choices that vary throughout different phases of the market.The psychological landscape of market cycles is marked by distinct behaviors that traders exhibit as conditions shift.

These behaviors often stem from common psychological traps that can profoundly impact market trends. By recognizing these traps, traders can better manage their investments and avoid making impulsive decisions that could lead to significant losses.

Psychological Traps in Market Phases, Understanding Market Cycles in Crypto

Each phase of the market cycle brings its own set of psychological challenges that traders must navigate. Understanding these traps is essential for making informed decisions. The following points Artikel common psychological traps encountered during bullish and bearish phases:

- Optimism Bias during Bull Markets: Traders may overestimate future returns due to the prevailing positive sentiment, leading to excessive risk-taking.

- FOMO (Fear of Missing Out): As prices surge, the fear of missing potential gains drives traders to buy at peak prices, often resulting in losses when corrections occur.

- Confirmation Bias: Traders tend to seek information that supports their existing beliefs. In bull markets, this can lead to a disregard for warning signs and an underestimation of risks.

- Panic Selling in Bear Markets: As prices decline, fear can prompt hasty selling, often at a loss, as traders attempt to limit their exposure to further losses.

- Loss Aversion: The fear of losing money can paralyze traders, causing them to hold onto losing positions instead of cutting losses early.

- Herd Behavior: During both market peaks and troughs, traders may follow the crowd, succumbing to the collective sentiment rather than relying on their analysis.

Each of these psychological traps can lead to poor decision-making and can exacerbate the volatility of the market. By being aware of these tendencies, traders can take proactive steps to mitigate their effects, such as setting clear investment goals, using stop-loss orders, and adhering to disciplined trading strategies.

Understanding psychological traps is essential to avoid emotional trading and enhance decision-making during market cycles.

Strategies for Navigating Market Cycles

In the dynamic world of cryptocurrency, understanding market cycles is essential for traders aiming to maximize their returns and mitigate risks. Adapting strategies based on whether the market is in a bull or bear phase can significantly influence trading success. Each cycle phase presents unique challenges and opportunities that require tailored approaches.Navigating market cycles requires a deep understanding of both the current market sentiment and historical patterns.

Successful traders often share common methodologies that adapt to changing conditions, leveraging tools, indicators, and psychological insights to guide their decisions. Recognizing these strategies can empower traders to make more informed choices.

Methodologies for Adapting Strategies

Several methodologies exist for traders to adjust their strategies depending on the market cycle phase. These approaches emphasize flexibility and risk management:

1. Trend Following

In a bull market, traders may implement trend-following strategies, buying on pullbacks and riding the momentum. This means entering positions as prices break above resistance levels or as bullish patterns form.

2. Risk Management

During bear markets, employing strict risk management techniques is crucial. This includes using stop-loss orders to limit potential losses and diversifying portfolios to reduce exposure to any single asset.

3. Value Investing

In bearish conditions, traders can adopt value investing strategies, seeking undervalued assets that may have strong fundamentals. The goal is to accumulate these assets when prices are low, anticipating a recovery in the next bull cycle.

4. Market Sentiment Analysis

Utilizing sentiment analysis tools helps traders gauge the mood of the market. In times of optimism, it’s wise to take on more risk, while in periods of fear, reducing exposure can be beneficial.

5. Automated Trading

Implementing algorithmic trading strategies can assist traders in making decisions based on preset conditions without emotional interference. This is especially useful in volatile markets.

Success Stories of Traders

Numerous traders have effectively navigated various market cycles, demonstrating the importance of strategy adaptation. One notable example is a trader who recognized the early signs of the 2020 bull market following Bitcoin’s halving event. By increasing their exposure to Bitcoin and altcoins, using technical indicators to confirm entry points, they were able to realize substantial gains during the upward trend.Conversely, during the 2018 bear market, another trader employed a diversification strategy.

By reallocating funds into stablecoins and traditional assets, they preserved capital and avoided significant losses as the market downturn continued. Their foresight in recognizing the bearish trend and acting accordingly allowed them to re-enter the market at lower prices once the conditions improved.

Strategies for Bull and Bear Markets

Understanding and implementing specific strategies tailored to each market phase can greatly enhance trading outcomes. Here’s a structured overview:In a bull market, traders often aim to capitalize on rising prices through aggressive buying strategies, while in a bear market, the focus shifts to preservation and risk mitigation.

- Bull Market Strategies

- Buy and Hold: Accumulate promising assets and hold for long-term gains.

- Leverage Trading: Use margin trading to amplify profits during upward trends.

- Stop-Loss Orders: Set trailing stop-losses to protect profits while allowing for gains.

- Bear Market Strategies

- Short Selling: Profit from declining prices by shorting overvalued assets.

- Safe Havens: Shift to stablecoins or fiat to preserve capital.

- Dollar-Cost Averaging: Invest fixed amounts regularly to lower average costs during downturns.

Utilizing these strategies helps traders navigate the complexities of market cycles more effectively, allowing for better risk management and potential profitability. Traders who remain adaptable and informed can leverage market cycles to their advantage.

Future Trends in Cryptocurrency Market Cycles: Understanding Market Cycles In Crypto

Source: decimalchain.com

As the cryptocurrency landscape continues to evolve, understanding future trends is essential for investors and enthusiasts alike. Emerging patterns and innovations could significantly shape the way market cycles unfold, impacting everything from investment strategies to regulatory frameworks. Staying ahead of these trends is crucial for navigating the complexities of this dynamic market.The cryptocurrency market is heavily influenced by various factors, including technological advancements, regulatory changes, and shifts in consumer behavior.

Emerging trends such as the rise of decentralized finance (DeFi), increased institutional adoption, and innovations in blockchain technology are expected to play pivotal roles in shaping future market cycles.

Emerging Trends Influencing Market Cycles

Understanding these trends provides a framework for anticipating market behavior and making informed investment decisions. The points below highlight key emerging trends that are likely to impact future cryptocurrency cycles:

- Decentralized Finance (DeFi): The growth of DeFi platforms is fostering new investment avenues, altering the demand for traditional financial services. This shift could lead to more significant market volatility as new projects emerge and capture investor interest.

- Institutional Investment: Increased participation from institutional investors is changing market dynamics, leading to potential price stabilization and longer-term investment horizons. This trend may also result in greater market maturity.

- Regulatory Developments: Ongoing government scrutiny and regulatory frameworks can significantly influence market cycles. Clear regulations may help in reducing market manipulation and enhance investor confidence.

- Technological Innovations: Advancements in blockchain technology, such as layer-2 solutions and interoperability protocols, could enhance transaction speeds and reduce costs. These improvements may stimulate wider adoption and increase market activity.

- Environmental Sustainability: Growing concerns over the environmental impact of cryptocurrency mining could influence market cycles. Projects focusing on eco-friendly practices may gain favor, attracting like-minded investors and reshaping the market landscape.

- Emergence of Central Bank Digital Currencies (CBDCs): The introduction of CBDCs can affect public perception of cryptocurrencies, potentially leading to increased regulation and a more structured market environment.

Predictions from Industry Experts

Industry analysts and experts offer insights into how these trends may manifest in future market cycles. Here are some predictions that highlight potential outcomes based on current trajectories:

- According to a report by Fidelity, institutional investors are expected to comprise a significant portion of the market, leading to increased institutional-grade products and services by 2025.

- Coinbase has indicated that the DeFi space could see exponential growth, projecting that its market capitalization could surpass traditional finance sectors within the next five years.

- Experts at Gartner predict that by 2024, up to 75% of enterprises will implement blockchain technology, thereby accelerating market cycles through increased transactions and utility.

- Based on current trends, 2023 has been labeled as a pivotal year for regulatory clarity, with many experts suggesting that defined rules will usher in a new wave of investment and market stability.

- Analysts foresee an increase in eco-conscious cryptocurrencies, predicting that projects which prioritize sustainability will see heightened interest and investment, reshaping market cycles by attracting a broader demographic of investors.

Wrap-Up

In conclusion, understanding market cycles in crypto is essential for anyone looking to thrive in this volatile landscape. By recognizing the phases and employing effective strategies, traders can not only mitigate risks but also capitalize on potential gains. As the cryptocurrency market evolves, staying informed about emerging trends and psychological influences will be vital in navigating its complexities.

FAQ Corner

What are the main phases of a crypto market cycle?

The main phases are accumulation, uptrend, distribution, and downtrend.

How can I identify when a market is in a downtrend?

Indicators like moving averages and RSI can help signal a downtrend.

What role does psychology play in market cycles?

Psychological factors like FOMO can greatly influence trader behavior and market movements.

Are there specific strategies for bull and bear markets?

Yes, strategies differ for each market phase; adapting your approach is key to success.

How do technological advancements affect market cycles?

Technological innovations can lead to new market dynamics and influence future cycles significantly.