The Most Underrated Altcoins With Real Utility Revealed

Delving into The Most Underrated Altcoins With Real Utility, this exploration invites you to uncover altcoins that not only exist in the shadows of mainstream attention but also offer meaningful benefits in various sectors. Altcoins, or alternative cryptocurrencies to Bitcoin, are gaining significance in the ever-evolving digital currency ecosystem, especially those that provide real utility to users and industries alike.

Despite their potential, many of these altcoins remain underrated, often overlooked by investors who are drawn to more prominent names in the market.

Understanding the concept of utility in cryptocurrencies is crucial, as it highlights the practical applications that can drive value and adoption. This piece will guide you through identifying undervalued altcoins, examining specific cases, and discussing the sectors benefiting from these innovations, as well as the future trends that could enhance their value.

Introduction to Altcoins with Utility

Altcoins, short for alternative coins, are any cryptocurrencies other than Bitcoin. They play a crucial role in the cryptocurrency market by expanding the range of digital assets available to investors and users. Unlike Bitcoin, which primarily serves as a store of value, altcoins often focus on specific functionalities, offering diverse solutions that can enhance blockchain technology and meet various user needs.Utility in cryptocurrencies refers to the practical applications and functions that a particular coin or token can provide within its ecosystem.

These utilities are essential because they determine how a cryptocurrency can be utilized in real-world scenarios beyond mere trading or investment. The presence of tangible utility can elevate an altcoin’s value proposition, making it more attractive to users and investors alike.Despite having genuine utility, many altcoins remain underrated. This can be attributed to various factors, including market volatility, media attention often skewed towards more popular cryptocurrencies, and a lack of understanding among the general public regarding the potential benefits these altcoins can provide.

This disconnect can lead to undervaluation, presenting opportunities for savvy investors to explore promising projects that may not yet be on the mainstream radar.

Understanding Utility in Cryptocurrencies

Various altcoins are designed with specific utilities that cater to distinct needs within the blockchain ecosystem. This section explores the significance of these utilities and how they differentiate various altcoins:

- Transaction Speed and Cost: Many altcoins, such as Ripple (XRP), focus on facilitating faster and cheaper transactions compared to Bitcoin. Ripple aims to streamline cross-border payments for banks and financial institutions, showcasing real utility in reducing transaction times and fees.

- Smart Contracts: Ethereum introduced the concept of smart contracts, enabling developers to create decentralized applications (dApps) on its blockchain. This utility has led to a thriving ecosystem and positioning Ethereum as a leader in the altcoin market.

- Privacy Features: Altcoins like Monero (XMR) and Zcash (ZEC) prioritize user privacy and anonymity. Their unique technologies ensure that transactions are confidential, catering to users who value discretion in their financial dealings.

- Tokenization of Assets: Platforms like Chainlink (LINK) allow for the tokenization of real-world assets, providing liquidity and accessibility to various markets. This utility broadens the scope for asset management and investment opportunities.

- Decentralized Finance (DeFi): Certain altcoins power DeFi platforms, enabling users to lend, borrow, and earn interest on cryptocurrencies without traditional intermediaries. Coins like Aave (AAVE) exemplify this utility by empowering users with decentralized financial tools.

“The utility of an altcoin is often a key indicator of its potential longevity and success in the fast-evolving crypto landscape.”

Understanding these utilities is crucial for navigating the altcoin space effectively. Investors who recognize the inherent value of altcoins with real utility may find themselves well-positioned to reap the benefits of emerging technologies and applications in the cryptocurrency market.

Identifying Underrated Altcoins

In the fast-evolving world of cryptocurrency, many altcoins with genuine utility remain overshadowed by more prominent players like Bitcoin and Ethereum. Understanding how to identify these underrated altcoins can open up potential investment opportunities. This section will Artikel key criteria for spotting undervalued altcoins that offer real-world applications and benefits.Identifying undervalued altcoins requires careful assessment of several factors that can highlight their potential.

Investors should look for altcoins that possess strong fundamentals, real-world utility, and supportive community engagement. Additionally, analyzing market trends and understanding the project’s roadmap can reveal promising investments that are currently overlooked.

Criteria for Identifying Underrated Altcoins

When evaluating altcoins, consider the following criteria that can help determine their value and utility:

- Real-World Use Cases: Altcoins that solve specific problems or enhance existing systems are more likely to gain traction. Look for projects with practical applications, such as supply chain management, decentralized finance (DeFi), or data storage solutions.

- Development Activity: A strong development team and active GitHub repositories often indicate that a project is continually improving. Regular updates and community engagement can signal long-term viability.

- Market Capitalization: Altcoins with a lower market cap may have more growth potential. While they can be riskier, they might also be undervalued compared to their more established counterparts.

- Community Support: A vibrant and engaged community can drive interest and adoption. Look for altcoins with active social media presence and community initiatives.

Examples of Overlooked Altcoins, The Most Underrated Altcoins With Real Utility

Several altcoins with real utility have remained under the radar despite their promising technology and applications. Here are a few examples:

- Chainlink (LINK): This decentralized oracle network connects smart contracts to real-world data, enabling a myriad of applications in various sectors such as finance and insurance.

- VeChain (VET): Focused on supply chain management, VeChain utilizes blockchain technology to improve transparency and efficiency in tracking products from production to delivery.

- Basic Attention Token (BAT): This token is integrated with the Brave browser, rewarding users for viewing ads while respecting their privacy, fostering a more equitable advertising ecosystem.

Potential Risks and Rewards of Investing in Underrated Altcoins

Investing in undervalued altcoins offers a unique set of opportunities and challenges. Recognizing these can help investors make informed decisions.

Investing in underrated altcoins can yield significant returns, but it carries inherent risks related to market volatility and project viability.

Some potential rewards include high returns if the altcoin gains wider recognition or fulfills its utility promises. For instance, if a project successfully partners with major corporations, its value could skyrocket. Conversely, risks include the possibility of project failure due to lack of funding, competition, or regulatory issues. Additionally, illiquidity can pose challenges when trying to exit positions.Understanding these elements is crucial for anyone looking to invest in the crypto space, particularly in altcoins that have yet to capture the mainstream investor’s attention.

Case Studies of Specific Altcoins

Exploring undervalued altcoins that showcase real utility can help investors identify hidden gems within the cryptocurrency market. In this section, we will focus on three specific altcoins that not only demonstrate significant potential but also provide practical use cases across various industries. These altcoins have shown resilience and innovation, positioning themselves favorably in the evolving landscape of digital currencies. Each coin features distinct utilities that cater to a variety of needs, making them stand out in a crowded market.

Highlighted Underrated Altcoins

The following altcoins have been selected based on their unique purposes and the benefits they offer to users. This comparison will help illustrate their market performance, features, and overall utility.

| Altcoin | Purpose | Utility | Market Performance |

|---|---|---|---|

| VeChain (VET) | Supply Chain Management | Enables businesses to streamline their supply chains using blockchain technology | Market Cap: $1.5 Billion, Price: $0.055 |

| Basic Attention Token (BAT) | Digital Advertising | Rewards users for viewing ads while providing advertisers with better ROI | Market Cap: $500 Million, Price: $0.25 |

| Holo (HOT) | Decentralized Hosting | Facilitates the hosting of decentralized applications on a peer-to-peer network | Market Cap: $500 Million, Price: $0.01 |

User experiences provide valuable insight into the real-world applications of these altcoins.

“VeChain has completely transformed how we manage our supply chain logistics, ensuring transparency and accountability.”

Supply Chain Manager at a Global Retailer

“With BAT, I not only get paid for my attention but also enjoy a seamless browsing experience without intrusive ads.”

Digital Marketing Professional

“Holo’s decentralized hosting has revolutionized our approach to application deployment, making it more cost-effective and efficient.”

Tech Startup Founder

These testimonials underscore the tangible benefits that these altcoins provide, highlighting their potential as foundational tools in their respective industries.

Utility in Different Sectors

The rise of altcoins has sparked innovation across various industries, showcasing their potential to transform traditional systems. By leveraging blockchain technology, these cryptocurrencies enhance efficiency, security, and transparency, making them invaluable in today’s digital economy. Different sectors are increasingly adopting altcoins to streamline operations and introduce novel solutions that address specific challenges. For instance, the finance sector utilizes altcoins for faster transactions and lower fees, while healthcare incorporates them for secure patient data management.

Key Sectors Benefiting from Altcoin Innovations

Understanding how altcoins are being applied across multiple industries highlights their diverse utility. Here are the primary sectors experiencing significant advancements through altcoin technology:

- Finance: Altcoins like Ripple (XRP) are revolutionizing cross-border payments, allowing for quick and cost-effective transactions without the need for traditional banking intermediaries.

- Healthcare: Projects like Medicalchain utilize blockchain to securely store patient records, improving data accessibility and interoperability among healthcare providers.

- Supply Chain: VeChain is enhancing supply chain operations by offering transparency and traceability, ensuring that products can be tracked from their origin to the end consumer.

- Real Estate: Altcoins such as Propy facilitate real estate transactions through smart contracts, streamlining processes like title transfers and escrow services.

- Gaming: Platforms like Enjin are integrating blockchain to provide true ownership of in-game assets, allowing players to buy, sell, and trade items across different games.

Utilizing altcoins in these sectors not only drives innovation but also addresses traditional pain points, leading to enhanced operational efficiencies and user experiences.

“The adaptability of altcoins across various sectors showcases their potential to solve real-world problems and improve existing systems.”

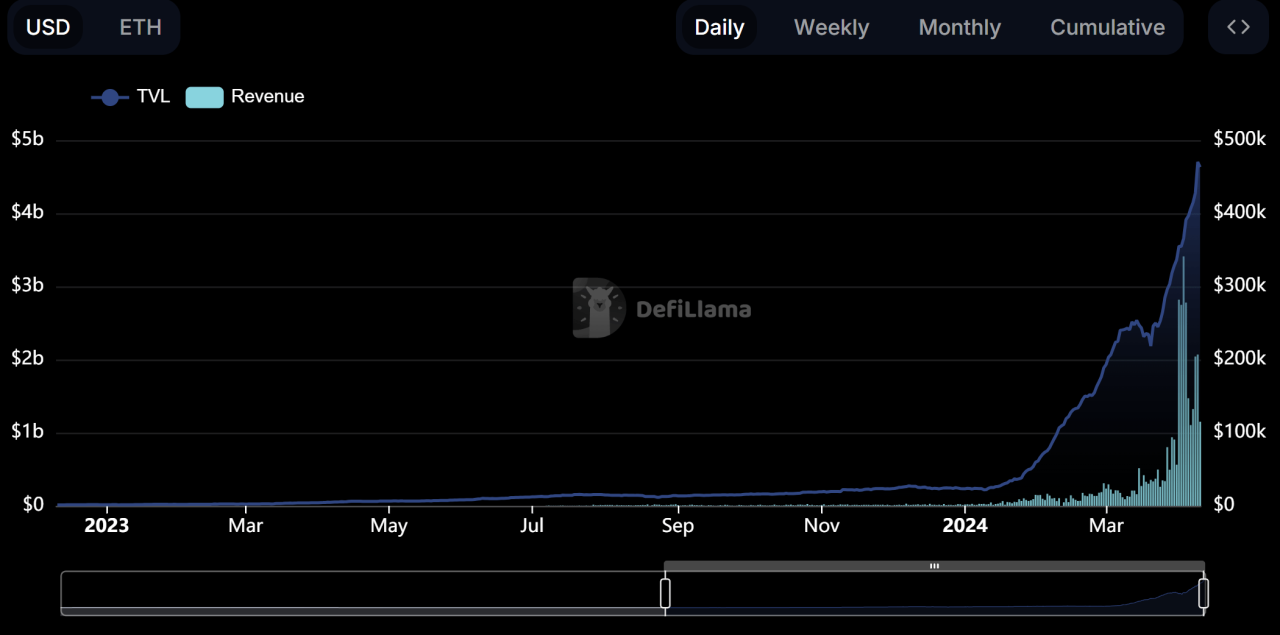

Future Potential and Trends: The Most Underrated Altcoins With Real Utility

Source: coingape.com

The cryptocurrency landscape is rapidly evolving, and utility-driven altcoins are positioned to capitalize on this growth. As the market matures, the focus is shifting from speculative investments to cryptocurrencies that offer real-world applications and solutions. This trend not only enhances their value proposition but also attracts a broader audience who seeks sustainable outcomes in their investments.Technological advancements are playing a crucial role in elevating the utility of underappreciated altcoins.

Innovations such as decentralized finance (DeFi), non-fungible tokens (NFTs), and layer-two scaling solutions are paving the way for altcoins to integrate into various sectors effectively. These advancements are essential as they address existing limitations within blockchain technology, allowing for increased transaction speeds, lower fees, and enhanced security.

Emerging Trends in the Cryptocurrency Market

A few key trends indicate a bright future for utility-driven altcoins. The following points illustrate how these trends are shaping the market:

- Increased adoption of DeFi platforms: As more users engage with decentralized financial services, altcoins that facilitate these transactions are likely to see heightened demand.

- Growing emphasis on sustainability: Blockchain projects focusing on energy efficiency and eco-friendly practices are gaining traction, as they align with global sustainability goals.

- Institutional investment interest: Major financial institutions are starting to invest in altcoins with tangible use cases, which could enhance liquidity and boost overall market confidence.

- Integration with traditional finance: Partnerships between blockchain projects and conventional financial institutions enhance the credibility and usability of various altcoins, fostering broader acceptance.

Technological Advancements Enhancing Utility

Several technological advancements are poised to increase the utility of less recognized altcoins, making them more appealing to investors and users alike:

- Smart contracts: These programmable contracts automate processes, minimizing the need for intermediaries and increasing efficiency across sectors.

- Interoperability solutions: Technologies that facilitate communication between different blockchains will enable altcoins to operate seamlessly across varied ecosystems.

- Scalability improvements: Enhancements such as sharding and layer-two protocols can significantly reduce congestion on networks, allowing for faster and cheaper transactions.

- Advanced security measures: Innovations in cryptography and decentralized identity solutions can increase trust, leading to higher adoption rates.

Future Performance Predictions

Based on current data trends, the following table showcases predictions for the future performance of select utility-driven altcoins. These estimates are grounded in market analysis and existing data:

| Altcoin | Current Price (USD) | Projected Price (1 Year) | Projected Price (5 Years) | Utility Sector |

|---|---|---|---|---|

| Chainlink (LINK) | 25.00 | 35.00 | 100.00 | DeFi, Oracles |

| VeChain (VET) | 0.12 | 0.25 | 0.80 | Supply Chain Management |

| Basic Attention Token (BAT) | 0.65 | 1.00 | 3.00 | Digital Advertising |

| Algorand (ALGO) | 1.50 | 3.00 | 10.00 | Smart Contracts, DeFi |

Community and Development Support

Community support plays a vital role in the success and sustainability of altcoin projects. A strong community not only provides a loyal user base but also fosters innovation and engagement, acting as a catalyst for growth. When enthusiasts rally around an altcoin, they contribute to its development, create awareness, and often help in troubleshooting issues. This supportive ecosystem can significantly enhance the value proposition of altcoins, making them more resilient to market fluctuations.The level of developer engagement within an altcoin project is equally crucial.

Active developers contribute to the continuous evolution and improvement of the project, addressing bugs, adding features, and ensuring the network remains secure. Altcoins that boast both community enthusiasm and dedicated developer support stand a much better chance of achieving long-term success.

Examples of Strong Community Backing and Developer Engagement

Projects that have demonstrated robust community support and active development include:

Cardano (ADA)

Known for its academic approach to blockchain technology, Cardano has a dedicated community that participates in governance and development discussions. The project emphasizes ongoing research and peer-reviewed updates, creating a sense of involvement among stakeholders.

Polkadot (DOT)

With a strong developer community and a focus on interoperability, Polkadot has garnered significant grassroots support. Its community engages in initiatives that emphasize the project’s utility across various blockchains.

Chainlink (LINK)

This platform for decentralized oracles has a vibrant community that actively participates in discussions, enhances the protocol, and shares ideas for future developments. The developer community continuously contributes to expanding its use cases in smart contracts.

Tezos (XTZ)

Tezos stands out for its on-chain governance model, allowing community members to propose and vote on upgrades. This collaborative approach fosters a sense of ownership and responsibility among its users.Community-driven initiatives significantly contribute to the utility of these altcoins. These initiatives can vary widely and often reflect the collective interests and goals of their respective communities. Here are some examples:

- Hackathons and Developer Contests: Many altcoin projects organize events to encourage developers to build applications and solutions that leverage their blockchain technology.

- Educational Programs: Communities often conduct workshops, webinars, and tutorials to help new users and developers understand the technology and its applications.

- Community Funds and Grants: Some projects allocate funds to support community-led initiatives, such as development proposals or projects that improve the ecosystem.

- Open Source Contributions: Active community members contribute to the codebase, helping to improve the software and add features, which bolsters the dev support.

- Social Media Engagement: Communities leverage platforms like Discord, Telegram, and Twitter to keep members informed, engaged, and involved in discussions regarding future developments.

Strategies for Investing in Utility-Focused Altcoins

Source: newsbtc.com

Investing in utility-focused altcoins can be a rewarding venture, especially when you identify those that are undervalued. As the cryptocurrency market continues to evolve, it is crucial to adopt effective investment strategies that align with the unique characteristics of these altcoins. This section Artikels essential strategies and highlights the importance of thorough research and due diligence before making investment decisions.Conducting comprehensive research is imperative when investing in altcoins with tangible utility.

Investors must analyze the project’s fundamentals, including its use case, team background, market potential, and community engagement. Understanding these factors helps in making informed decisions and minimizing risks associated with investing in lesser-known altcoins.

Investment Strategies for Undervalued Altcoins

Several strategies can be applied when investing in utility-focused altcoins. Below are some common approaches and their effectiveness:

- Value Investing: This strategy involves identifying altcoins that are undervalued relative to their potential utility. By focusing on projects with solid fundamentals and real-world applications, investors can capitalize on price appreciation over time.

- Dollar-Cost Averaging (DCA): DCA is an investment strategy where investors consistently buy into an altcoin at regular intervals, regardless of price fluctuations. This reduces the impact of volatility and averages out the purchase price, making it a safer approach.

- Long-Term Holding: Holding altcoins for the long term can yield significant returns, especially for projects with strong utility and growing adoption. This strategy requires patience and a belief in the project’s long-term value proposition.

- Community Engagement: Actively participating in the community surrounding an altcoin can provide valuable insights and keep investors informed about the latest developments. Engaging with other investors and project developers can lead to better decision-making.

- Technical Analysis: Utilizing technical analysis involves studying price charts and market trends to make informed trading decisions. This strategy can help identify entry and exit points, especially in a volatile market.

The effectiveness of these strategies can vary depending on market conditions, the specific altcoin, and the investor’s risk tolerance. Below is a comparison table summarizing these strategies and their respective effectiveness in altcoin investment.

| Strategy | Effectiveness | Notes |

|---|---|---|

| Value Investing | High | Best for identifying long-term opportunities. |

| Dollar-Cost Averaging | Medium | Reduces risk but may miss out on lower prices. |

| Long-Term Holding | High | Requires conviction in the project’s future. |

| Community Engagement | Medium | Helps in staying informed; less direct impact on returns. |

| Technical Analysis | Variable | Effective in short-term trading but requires expertise. |

Investors should consider their personal investment goals and risk tolerance when choosing or combining these strategies. By doing so, they can effectively capitalize on the potential of undervalued altcoins with real-world utility.

Last Point

Source: getblogo.com

In conclusion, as we explored The Most Underrated Altcoins With Real Utility, it becomes evident that there is a wealth of opportunity within the realm of lesser-known altcoins. These digital currencies not only have the potential to revolutionize various industries but also present unique investment opportunities for those willing to look beyond the mainstream. By staying informed and engaged with these altcoins, investors can position themselves to benefit from future growth and innovation.

General Inquiries

What are altcoins?

Altcoins are cryptocurrencies other than Bitcoin, often designed to improve upon or provide alternatives to Bitcoin’s features.

Why are some altcoins underrated?

Many altcoins lack visibility, marketing, or mainstream acceptance, despite having strong use cases or innovative technology.

How can I identify underrated altcoins?

Look for projects with strong community support, real-world utility, and innovative technology that have not yet gained significant market attention.

What risks are associated with investing in altcoins?

Investing in altcoins can be risky due to market volatility, lack of regulation, and the potential for project failure.

How can I research altcoins effectively?

Utilize resources like whitepapers, community forums, and market analysis tools, and always perform due diligence before investing.