How to Use On-Chain Data for Trading Decisions Effectively

How to Use On-Chain Data for Trading Decisions lays the groundwork for a fascinating exploration of the intersection between blockchain technology and trading strategies. On-chain data represents a treasure trove of information that can reveal market trends and investor behavior, offering traders valuable insights that go beyond traditional analysis. By understanding and leveraging this data, traders can enhance their decision-making processes and potentially increase their profitability.

Whether you’re new to trading or a seasoned investor, the significance of on-chain data cannot be overstated. From transaction volumes to wallet addresses, this data holds the key to understanding market dynamics in real-time. In this discussion, we will delve into how to interpret on-chain data, the tools available for analysis, and how to effectively incorporate this information into your trading strategies.

Understanding On-Chain Data

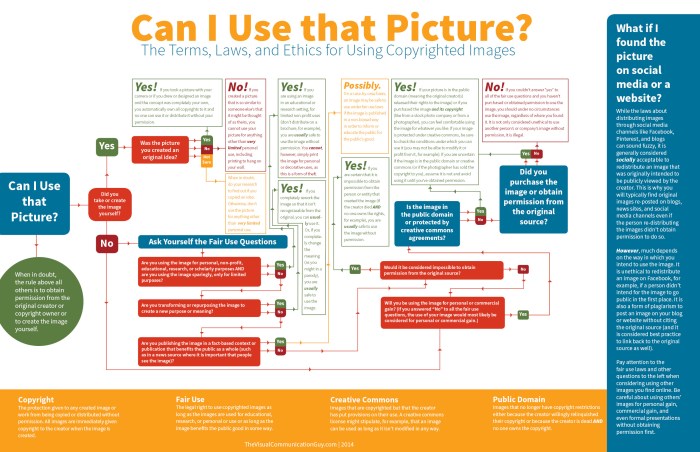

Source: thevisualcommunicationguy.com

On-chain data refers to information that is recorded on the blockchain, providing insights into various activities and behaviors within a cryptocurrency network. Its significance in trading stems from the fact that it offers a transparent and immutable view of market dynamics, enabling traders to make informed decisions based on real-time information and historical trends.On-chain data encompasses various types of information that traders can analyze to gauge market sentiment, identify trends, and make strategic trading decisions.

For instance, transaction volume reflects the level of activity within the network and can indicate heightened interest in a particular asset. Similarly, the number of unique wallet addresses holding a specific cryptocurrency can provide insights into its distribution and investor engagement.

Types of On-Chain Data

Understanding the different types of on-chain data is essential for traders looking to leverage this information effectively. The following are key types of on-chain data that can significantly impact trading decisions:

- Transaction Volume: This represents the total number of transactions processed on the blockchain within a specific period. A surge in transaction volume can indicate increased interest and potential price movements.

- Wallet Addresses: The number of active wallet addresses can serve as a metric for assessing the level of participation in a cryptocurrency. A growing number of addresses often correlates with rising interest in an asset.

- Hash Rate: This reflects the computational power being employed to secure a blockchain network. A higher hash rate can indicate a more secure network and greater miner confidence, influencing traders’ perceptions of investment safety.

- Exchange Inflows and Outflows: Tracking the amount of cryptocurrency entering and leaving exchanges can provide insights into investor behavior. Increased inflows may suggest selling pressure, while outflows can indicate accumulation.

- Token Age Consumed: This metric reflects the age of tokens that have been moved from one address to another. A spike in token age consumed can imply that long-term holders are starting to sell, which might affect price movements.

Accessing on-chain data is crucial for traders who want to incorporate it into their strategies. Various platforms and tools provide this data, including:

- Blockchain Explorers: Websites like Etherscan and Blockchair allow users to explore transaction histories, wallet balances, and more, offering a wealth of on-chain information.

- Analytics Platforms: Solutions like Glassnode and Dune Analytics offer advanced analytics and visualizations, enabling traders to derive insights from large datasets effectively.

- API Services: APIs from providers such as CryptoCompare and Nomics allow developers and traders to access real-time on-chain data programmatically for customized analysis.

Utilizing these sources empowers traders to keep a pulse on market trends and make strategic decisions based on factual data rather than speculation.

“On-chain data transforms the way traders view market dynamics, offering a lens into real-time activities and historical patterns that are critical for informed decision-making.”

The Role of On-Chain Data in Trading Decisions

On-chain data has become a pivotal element in the world of cryptocurrency trading, offering traders unique insights that can shape their decision-making processes. As the blockchain retains a permanent record of transactions and wallet activities, this data can reflect market sentiment and economic trends. Understanding how to effectively utilize on-chain data can lead to more informed and strategic trading decisions.The influence of on-chain data on market sentiment is significant.

By analyzing patterns in transaction volume, wallet balances, and user activity, traders can gauge the overall mood of the market. For instance, a surge in transaction volume often indicates heightened interest in a particular asset, which can lead to price increases. Conversely, a decline in transaction activity may signal waning interest, prompting traders to reconsider their positions. Traders can track metrics such as the number of active addresses or the flow of funds into and out of exchanges to assess whether the sentiment is bullish or bearish.

Patterns Derived from On-Chain Data

Identifying and interpreting patterns from on-chain data can provide traders with valuable insights into market trends. The key patterns include:

- HODLing vs. Selling: By examining wallet balances over time, traders can determine whether long-term holders are accumulating or if short-term traders are actively selling. A significant increase in HODLing can suggest bullish sentiment, while widespread selling may indicate bearish trends.

- Exchange Inflows and Outflows: Monitoring the movement of assets between wallets and exchanges helps traders understand supply and demand dynamics. High inflows into exchanges often precede selling pressure, while increased outflows can signify accumulation.

- Transaction Fees and Volume: Analysis of transaction fees alongside volume can reveal underlying demand. Rising fees with increasing volume can indicate a bullish market, whereas falling fees with decreasing volume may signal a bearish outlook.

By leveraging these patterns, traders can enhance their decision-making processes and align their strategies with market movements. Understanding the intricacies of on-chain data allows for a deeper analysis of market behavior and potential future price actions.

Leveraging On-Chain Data for Informed Decision-Making

Traders can effectively incorporate on-chain data into their trading strategies through various approaches. Some practical methods include:

- Setting Alerts Based on On-Chain Metrics: Implementing alerts for significant changes in on-chain data, such as large transactions or notable shifts in wallet balances, can help traders react quickly to market movements.

- Combining On-Chain Data with Technical Analysis: Using on-chain insights alongside traditional technical analysis can improve the accuracy of predictions. For instance, a technical breakout accompanied by positive on-chain data can reinforce the likelihood of a sustained price movement.

- Conducting Sentiment Analysis: Regularly assessing on-chain metrics like the number of active addresses or social media sentiment can provide a holistic view of the market, helping traders anticipate potential shifts before they occur.

By applying these strategies, traders can make data-driven decisions rooted in empirical evidence, thus enhancing their chances of success in the volatile cryptocurrency market.

Tools and Platforms for Analyzing On-Chain Data

Source: youglish.com

As the cryptocurrency market continues to evolve, traders are increasingly turning to on-chain data to enhance their trading strategies. Utilizing various tools and platforms can provide valuable insights that inform decision-making and improve trading outcomes. Each tool offers unique features tailored to different trading approaches and preferences, making it essential to choose the right one for your needs.

Popular Tools for On-Chain Data Analysis

Several tools are widely recognized in the cryptocurrency community for their ability to analyze on-chain data effectively. Here’s a list of some of the leading platforms that traders use:

- Glassnode: Known for its comprehensive on-chain metrics and user-friendly interface, Glassnode provides insights into market behavior through real-time data analytics. It offers both free and premium subscription plans, catering to different user needs.

- Dune Analytics: This platform allows users to create custom queries and dashboards using SQL, making it highly flexible for analyzing on-chain data. Dune is particularly favored by data scientists and developers due to its community-driven approach and extensive database.

- CryptoQuant: CryptoQuant offers a suite of tools focused on on-chain metrics, including exchange flows and miner data. The platform provides insights that are particularly useful for short-term trading strategies.

- Nansen: Combining on-chain data with wallet labels, Nansen helps traders identify smart money movements and trends, making it an excellent resource for those looking to follow the strategies of successful investors.

- IntoTheBlock: IntoTheBlock provides an array of indicators based on on-chain, social, and technical data, making it suitable for traders looking for a holistic view of market dynamics.

Each of these platforms offers distinct advantages depending on the type of analysis you wish to conduct, whether it’s for short-term trading or long-term investment strategies.

Comparison of Platform Features

When choosing a platform for analyzing on-chain data, it’s crucial to consider the features that align with your trading strategy. Below is a comparison table outlining key functionalities of popular platforms:

| Platform | Key Features | Best For |

|---|---|---|

| Glassnode | Real-time metrics, alerts, charts | Long-term investors |

| Dune Analytics | Custom SQL queries, community dashboards | Data scientists |

| CryptoQuant | Exchange flow metrics, alerts | Short-term traders |

| Nansen | Wallet tracking, smart money analytics | Traders following large investors |

| IntoTheBlock | On-chain indicators, social sentiment analysis | Comprehensive market analysis |

When selecting a platform, consider your trading style and the depth of analysis required. For instance, long-term investors might prioritize platforms like Glassnode for its comprehensive metrics, while day traders may find CryptoQuant’s real-time data more beneficial.

Setting Up an Account on Dune Analytics

Setting up an account on Dune Analytics is a straightforward process that allows you to access its powerful analytical tools. Here’s a step-by-step guide to get you started:

1. Visit the Dune Analytics website

Go to the Dune Analytics homepage to begin the registration process.

2. Sign Up

Click on the ‘Sign Up’ button. You can register using your email address or connect via your GitHub account for a streamlined experience.

3. Verify Your Email

If you used your email to register, check your inbox for a verification email from Dune and click the link to activate your account.

4. Create Your Profile

Once verified, log in and complete your profile setup. You can customize your preferences for a personalized experience.

5. Explore the Dashboard

After setup, you’ll have access to the Dune dashboard. You can browse existing queries or start creating your own to analyze on-chain data based on your interests.By familiarizing yourself with the platform’s interface and tools, you can leverage Dune Analytics to enhance your trading strategy effectively.

Integrating On-Chain Data with Technical Analysis

The fusion of on-chain data with technical analysis creates a comprehensive trading strategy that enhances decision-making in cryptocurrency markets. By leveraging the strengths of both analytical approaches, traders can gain deeper insights into market dynamics, enabling them to identify more lucrative trading opportunities and manage risks effectively.Combining on-chain data with technical analysis offers several advantages, including improved market sentiment analysis and more accurate price predictions.

On-chain metrics such as transaction volumes, active addresses, and network growth provide a real-time picture of market health, while technical indicators help traders evaluate price trends and potential reversal points. This synergy can lead to more informed trading decisions.

Methods for Visualizing On-Chain Data Alongside Technical Indicators, How to Use On-Chain Data for Trading Decisions

Visualizing on-chain data in conjunction with technical indicators can significantly enhance the analysis process. There are various methods to achieve this, allowing traders to observe correlations and divergences between on-chain metrics and price movements.One effective method is to overlay on-chain metrics on price charts. For example, plotting the number of active addresses or transaction count as an additional line graph can reveal trends that precede price movements.

This allows traders to assess whether increasing network activity correlates with price uptrends.Another approach is to use candlestick charts to represent price movements while incorporating bar charts for volume and on-chain data metrics. This dual visualization enables traders to quickly identify trading signals and validate them against on-chain activity.

Examples of Successful Trading Strategies Incorporating Both Data Types

Several successful trading strategies have effectively integrated on-chain data with technical analysis, showcasing the potential of this combined approach. One example is the strategy of using the “Network Value to Transactions Ratio” (NVT Ratio). Traders monitor the NVT ratio alongside moving averages. When the NVT ratio indicates that the network is undervalued (a low ratio), and the price crosses above a moving average, it can signal a strong buy opportunity.Another example involves using the “Realized Price” in conjunction with the Relative Strength Index (RSI).

Traders monitor the realized price as a support level. When the price approaches this level while the RSI shows oversold conditions, it may signal a potential reversal, presenting an attractive buying opportunity.By combining these analytical tools, traders can create a more holistic view of the market, leading to strategic entries and exits based on both fundamental and technical insights.

Case Studies of Successful On-Chain Data Usage

Traders and firms leveraging on-chain data have seen significant improvements in their trading outcomes. These case studies illustrate how data-driven decisions can lead to profitable trades, showcasing the potential of utilizing on-chain metrics to inform strategies and optimize performance.The following section delves into specific case studies where traders and firms successfully harnessed on-chain data, providing insights into their strategies and respective outcomes.

The analysis highlights various approaches, further clarifying the impact of on-chain data in real-world trading scenarios.

Successful Case Studies

The relevance of different strategies and their outcomes can be assessed through these notable case studies where traders have effectively utilized on-chain data:

| Case Study | Trader/Firm | Strategy | Outcome |

|---|---|---|---|

| Bitwise Asset Management | Institutional Investment Firm | Analyzing wallet activity to forecast market movements | Increased AUM by 20% in Q2 2021 due to strategic investments based on wallet inflows. |

| Glassnode Insights | Data Analytics Firm | Utilizing on-chain metrics for predictive analysis | Identified a key market reversal, leading to a 15% profit for clients. |

| Chainalysis | Compliance Solutions Provider | Using transaction volume data to identify trading opportunities | Enabled law firms to predict market trends, resulting in a 10% increase in successful cases. |

| Arca | Digital Asset Management Firm | Incorporating on-chain data with traditional financial metrics | Achieved a 25% ROI over 12 months through informed trading strategies. |

The varying strategies employed by these firms highlight the versatility of on-chain data in trading. Each case demonstrates that thorough analysis of on-chain metrics can lead to informed decision-making and ultimately profitable outcomes.

“On-chain data is not just about numbers; it’s about understanding the market’s psychology.”

These case studies emphasize the importance of integrating on-chain data into trading strategies. They provide valuable lessons for future decisions, such as the necessity of adapting to market changes and continuously refining analysis techniques based on new data insights. Focusing on the behavior of market participants through on-chain metrics can significantly enhance a trader’s ability to forecast price movements and market trends effectively.

Challenges and Limitations of Using On-Chain Data: How To Use On-Chain Data For Trading Decisions

While on-chain data provides valuable insights into blockchain activity and market behavior, traders encounter several challenges and limitations when interpreting this information. On-chain analysis requires a deep understanding of blockchain technology and the context in which the data is generated. Furthermore, the rapidly evolving landscape of cryptocurrencies and decentralized finance (DeFi) can complicate the interpretation and application of on-chain metrics in trading decisions.Understanding the challenges faced by traders is crucial to effectively utilizing on-chain data for informed trading strategies.

Traders must navigate issues such as data interpretation, misconceptions surrounding on-chain metrics, and inherent limitations of the data itself.

Challenges in Interpreting On-Chain Data

Interpreting on-chain data can be complex due to various factors that influence the information presented. Traders often face challenges, such as:

- Data Overload: The sheer volume of on-chain data can overwhelm traders. From transaction volumes to wallet addresses, filtering through this data to find relevant insights requires both time and expertise.

- Noise in the Data: Not all on-chain activity is indicative of market behavior. Distinguishing between meaningful metrics and noise—such as spam transactions or temporary fluctuations—can be challenging.

- Lag in Data Reporting: On-chain metrics may not always reflect real-time market conditions. A trader might receive delayed data, leading to decisions based on outdated information.

Common Misconceptions about On-Chain Data Analysis

There are several misconceptions that can impair a trader’s understanding of on-chain data, leading to potentially poor trading decisions. These include:

- On-Chain Data is Always Accurate: Some traders assume that on-chain data is infallible. However, inaccuracies can arise from misinterpretations or errors in data aggregation.

- All On-Chain Activity is Bullish or Bearish: It is a common fallacy to view all on-chain activity through a binary lens. For example, high transaction volumes can signify both healthy network activity or panic selling.

- On-Chain Metrics Replace Technical Analysis: Many believe that on-chain data can solely dictate market movements. In reality, a comprehensive trading strategy should integrate both on-chain data and technical analysis for balanced insights.

Limitations of On-Chain Data

Despite its advantages, on-chain data is not without limitations that can impact trading decisions. These limitations include:

- Context Matters: On-chain data must be interpreted in context. A spike in transaction volume may signify different events in varying market conditions, such as hype surrounding a project or looming sell-offs.

- Privacy and Anonymity: The pseudonymous nature of blockchain transactions can obscure the true intentions behind any given transaction, making it difficult to deduce market sentiment.

- Network-Specific Variables: Data collected from different blockchains can vary widely based on their architecture. For instance, Ethereum’s smart contracts offer different insights compared to Bitcoin’s transactional focus.

“Understanding the limitations and challenges of on-chain data is essential for making informed trading decisions.”

Future Trends in On-Chain Data Utilization

The landscape of on-chain data utilization in trading is rapidly evolving, driven by advancements in technology and increasing interest in cryptocurrencies. As more traders and investors recognize the value of on-chain data, we can expect to see innovative approaches that enhance trading strategies and decision-making processes.The future of on-chain data is expected to be shaped by several factors, including the integration of advanced technologies and potential regulatory changes.

The following are emerging technologies that are likely to enhance the analysis of on-chain data:

Emerging Technologies for On-Chain Data Analysis

The interaction between newly developed technologies and on-chain data can lead to significant improvements in trading efficiency and insight generation. Understanding these technologies is vital for traders aiming to stay ahead of the curve. Here are some key technologies to watch:

- Artificial Intelligence (AI) and Machine Learning: These technologies are poised to analyze large datasets more efficiently, identifying patterns and trends that human analysts might overlook.

- Big Data Analytics: As on-chain data grows, tools that can handle and analyze vast amounts of data will become increasingly important, allowing for more comprehensive insights.

- Blockchain Interoperability Solutions: New protocols enabling different blockchains to communicate can provide a richer dataset, leading to more informed trading decisions.

- Decentralized Finance (DeFi) Analytics Tools: These platforms are emerging to provide traders with insights specifically tailored to DeFi markets, enhancing trade execution strategies.

- Predictive Analytics: Tools utilizing historical on-chain data to forecast future market movements will aid traders in making more strategic decisions.

The rise of these technologies is likely to lead to more sophisticated trading strategies, allowing traders to leverage on-chain data in ways that were previously unimaginable.

Potential Regulatory Impacts on On-Chain Data Usage

As on-chain data continues to gain traction in trading, regulatory frameworks are expected to evolve in response to its increasing importance. Regulations can significantly influence how traders use on-chain data, shaping the landscape of cryptocurrency trading. Greater regulatory scrutiny may lead to enhanced transparency and security, as authorities may require improved data reporting and compliance measures. A potential outcome could be the establishment of standardized protocols for data sharing and utilization.

Record-keeping requirements and data privacy laws could impact how on-chain data is leveraged for trading strategies. For instance, regulations similar to the General Data Protection Regulation (GDPR) in Europe could impose restrictions on data usage, requiring traders to adapt their strategies while remaining compliant.In summary, the future of on-chain data utilization in trading is promising and will likely be characterized by technological advancements and evolving regulatory landscapes.

Traders who can effectively navigate these changes will be better positioned to optimize their trading strategies.

Final Summary

Source: nasscom.in

In conclusion, integrating on-chain data into trading decisions offers a strategic edge in today’s fast-paced market environment. As we’ve explored, the insights gained from analyzing on-chain data can inform smarter, more calculated trading moves. By staying ahead of emerging trends and learning from successful case studies, traders can better navigate the complexities of the market, making informed decisions that ultimately lead to greater success.

FAQ

What is on-chain data?

On-chain data refers to information stored on a blockchain that reveals transaction histories, wallet balances, and other blockchain activities.

How can I access on-chain data?

On-chain data can be accessed through various platforms and tools like Glassnode, Dune Analytics, and others that specialize in blockchain data analysis.

Why is on-chain data important for traders?

On-chain data provides insights into market sentiment, helping traders make informed decisions based on real-time blockchain activities.

Can on-chain data predict market trends?

While it can offer insights into potential trends and patterns, it’s important to remember that no analysis can guarantee market predictions.

What are the challenges of using on-chain data?

Challenges include interpreting complex data correctly, understanding its context, and distinguishing between signal and noise in market trends.