How to Use Moving Averages in Crypto Trading Strategies

How to Use Moving Averages in Crypto is a crucial topic for anyone looking to navigate the complexities of cryptocurrency trading. Moving averages serve as essential tools that help traders identify market trends, entry and exit points, and overall performance of various cryptocurrencies. By understanding these averages, traders can enhance their strategies and make more informed decisions in a highly volatile market.

This guide will delve into the different types of moving averages, such as the Simple Moving Average (SMA) and Exponential Moving Average (EMA), and how they can be effectively implemented in trading strategies. We’ll also explore the calculation methods, interpretation of signals, and common pitfalls to watch out for, ensuring that you have a comprehensive understanding of this vital trading concept.

Introduction to Moving Averages in Crypto: How To Use Moving Averages In Crypto

Moving averages play a crucial role in the analysis and trading of cryptocurrencies. They provide traders with a smoothed average price over a specific time period, helping to filter out the noise from price fluctuations and identify the overall trend direction. This simplicity makes moving averages one of the most widely used tools in technical analysis, offering insight into potential entry and exit points in the volatile crypto market.In cryptocurrency trading, there are several types of moving averages, each with its own unique characteristics and applications.

The two most commonly used types are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). The SMA calculates the average price over a set number of periods, giving equal weight to all prices within that timeframe. In contrast, the EMA gives more weight to the most recent prices, making it more responsive to new information. These moving averages can help traders understand price trends, potential reversal points, and market momentum.

Types of Moving Averages

Understanding the different types of moving averages is key for traders looking to utilize them effectively in their strategies. Each type serves a specific purpose and can be utilized in various market conditions.

- Simple Moving Average (SMA): This is the most straightforward type, calculated by taking the average of a set number of closing prices. For example, a 50-day SMA sums up the closing prices of the last 50 days and divides by 50. It helps identify longer-term trends but can lag in rapidly changing markets.

- Exponential Moving Average (EMA): The EMA gives more weight to recent prices, making it faster to react to price changes. A trader might use a 20-day EMA to spot short-term trends, as it would respond more quickly to price shifts than an SMA of the same period.

- Weighted Moving Average (WMA): Similar to the EMA, the WMA assigns different weights to prices, but it uses a linear weighting scheme. This can be particularly useful for traders who want to avoid the lag associated with SMAs while still considering a broader set of historical data.

Each type of moving average can be beneficial in different trading scenarios. For example, during a strong uptrend, traders might use the EMA for quicker signals to enter or exit trades. Conversely, during a more volatile market, the SMA could help smooth out fluctuating prices, providing a clearer picture of the overall trend. Understanding these nuances enables traders to tailor their strategies based on market conditions and their individual trading styles.

“Moving averages are essential tools for identifying trends and potential reversal points, providing clarity amidst the volatility of the crypto market.”

By effectively utilizing moving averages, traders can enhance their decision-making processes, making informed trades based on historical price data and trend analysis.

Types of Moving Averages

Moving averages are indispensable tools in cryptocurrency trading, helping to smooth out price data to identify trends over a specific period. Among the various types of moving averages, the Simple Moving Average (SMA) and the Exponential Moving Average (EMA) are the most widely used. Understanding the differences between them can significantly enhance your trading strategy.The Simple Moving Average (SMA) calculates the average price of a cryptocurrency over a specific number of periods, providing a straightforward view of price trends.

In contrast, the Exponential Moving Average (EMA) gives more weight to the most recent prices, making it more responsive to new information. This responsiveness can be beneficial for traders looking to capitalize on short-term price movements.

Comparison of SMA and EMA

Both SMA and EMA have their unique advantages and disadvantages. Recognizing these can help traders choose the right moving average for their specific trading style and objectives. Advantages of SMA include its simplicity and ease of calculation. It provides a clear and smoothed representation of price data, making it easier to identify long-term trends. However, its lagging nature can be a drawback, as it may not react quickly to price changes.On the other hand, EMA’s responsiveness to recent price movements is a significant advantage, allowing traders to react promptly to market changes.

Nevertheless, this sensitivity can also lead to false signals during periods of high volatility, making it essential for traders to use EMA in conjunction with other indicators.Here’s a comparison table highlighting the key features of SMA and EMA:

| Feature | Simple Moving Average (SMA) | Exponential Moving Average (EMA) |

|---|---|---|

| Calculation Method | Average of prices over a specified period | Weighted average giving more importance to recent prices |

| Responsiveness | Slower to react to recent price changes | Faster and more responsive to recent price movements |

| Usage | Best for identifying long-term trends | Ideal for short-term trading and signals |

| Sensitivity to Volatility | Less sensitive, providing smooth price action | More sensitive, risking false signals |

| Complexity | Simple to calculate and understand | More complex due to weighting |

In summary, both SMA and EMA serve distinct purposes and can be beneficial depending on the trading strategy employed. By understanding their characteristics, traders can make informed decisions that align with their market analysis and trading goals.

How to Calculate Moving Averages

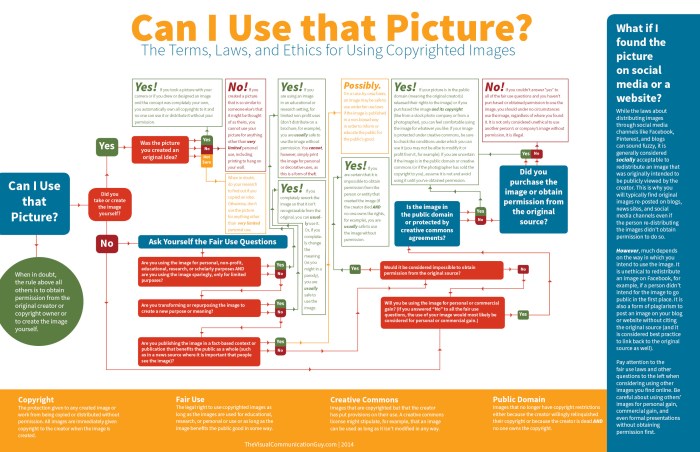

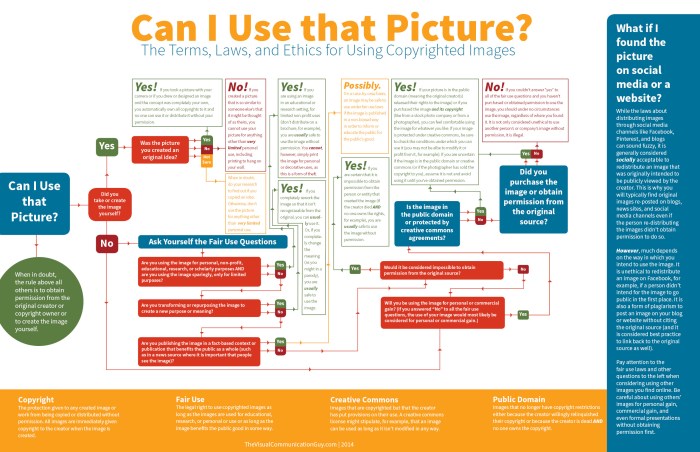

Source: thevisualcommunicationguy.com

Calculating moving averages is an essential skill for anyone involved in crypto trading, as it helps to smooth out price data and identify trends. Understanding how to compute both the Simple Moving Average (SMA) and the Exponential Moving Average (EMA) is crucial for making informed trading decisions.The process of calculating moving averages involves using specific formulas tailored to each type.

Below is a step-by-step guide to help you navigate through the calculations, along with practical examples to illustrate the concepts.

Calculation of Simple Moving Average (SMA), How to Use Moving Averages in Crypto

The Simple Moving Average is calculated by taking the average of a specified number of past price points. The formula for SMA is straightforward:

SMA = (P1 + P2 + P3 + … + Pn) / n

Where:

- P1, P2, P3, …, Pn are the price points.

- n is the number of periods.

To illustrate, let’s calculate the SMA based on the following closing prices of a cryptocurrency over five days: $10, $12, $14, $11, and $13.

1. Sum the closing prices

$10 + $12 + $14 + $11 + $13 = $60

2. Count the number of periods

There are 5 days (n = 5).

3. Calculate the SMA

SMA = $60 / 5 = $12Thus, the SMA for this period is $12.

Calculation of Exponential Moving Average (EMA)

The Exponential Moving Average gives more weight to recent prices, making it more responsive to new information. The formula for EMA is a bit more complex:

EMA = (Current Price

- (k)) + (Previous EMA

- (1 – k))

Where:

- k = 2 / (n + 1)

- n is the number of periods.

Let’s calculate the EMA for a 5-day period using the same closing prices: $10, $12, $14, $11, and $13. First, we need to calculate the SMA for the first period, which we’ll use as the initial EMA.

1. Calculate SMA for the first 5 days to use as the starting EMA

SMA = $12 (as computed earlier).

2. Calculate k

k = 2 / (5 + 1) = 2 / 6 = 0.3333.

3. Calculate the EMA for the 6th day (assuming the price is $15)

EMA = ($15

- 0.3333) + ($12

- (1 – 0.3333))

= ($5) + ($8) = $13.The EMA for the next period, when the closing price is $15, is $13.These calculations provide vital insights into price trends, enabling traders to make more informed decisions based on historical data. Understanding and applying these formulas is fundamental for anyone looking to utilize moving averages effectively in crypto trading.

Applying Moving Averages to Trading Strategies

Moving averages have become a cornerstone in the toolkit of many crypto traders. By smoothing out price data, they help identify trends and generate signals for potential buy or sell opportunities. Understanding how to apply moving averages effectively can enhance one’s trading strategy, leading to more informed decisions in a volatile market.Different trading strategies utilize moving averages in various ways to capitalize on market trends.

These strategies often revolve around the intersection of different moving averages, their relation to price action, or their integration into broader trading systems. Optimizing these strategies according to market conditions can significantly improve their effectiveness.

Crossover Strategies

Crossover strategies exploit the relationship between short-term and long-term moving averages. Generally, a trader would look for points where a shorter moving average crosses above or below a longer moving average. This is considered a signal to enter or exit trades.

- Golden Cross: This occurs when a short-term moving average (like the 50-day) crosses above a long-term moving average (like the 200-day). It is interpreted as a bullish signal, indicating potential upward momentum.

- Death Cross: On the flip side, when a short-term moving average crosses below a long-term moving average, it is termed a death cross. This is seen as a bearish signal, indicating a potential downtrend.

These signals are more reliable in trending markets rather than choppy price action, so traders should consider using additional indicators to confirm these signals.

Trend Following Strategies

Trend following strategies involve identifying and capitalizing on existing market trends. Traders can use moving averages to gauge the overall trend direction and make trading decisions accordingly.

- Simple Moving Average (SMA) Strategy: Traders often maintain positions in the direction of the trend indicated by the moving average. For example, if the price is above the 50-day SMA, traders might look for buying opportunities.

- Exponential Moving Average (EMA) Strategy: EMAs give more weight to recent prices, which can provide quicker signals in fast-moving markets. Traders often use the EMA to capture short-term trends while managing risk.

Both SMA and EMA strategies can be optimized by adjusting the periods used for calculations based on historical volatility and the trader’s risk tolerance.

Optimizing Strategies Based on Market Conditions

Adapting moving average strategies to current market conditions is crucial for improving their effectiveness. For periods of high volatility, traders might reduce the moving average period to react more swiftly to price changes. Conversely, during stable market phases, extending the moving average period can help filter out noise.

- Backtesting: Traders should backtest their moving average strategies against historical data to identify how their strategies would have performed under various market conditions.

- Combining Indicators: To improve reliability, combine moving averages with other indicators like Relative Strength Index (RSI) or MACD. This multi-faceted approach can provide more comprehensive signals.

- Adjusting Risk Management: Implementing stop-loss orders and position sizing based on the volatility of the market can help mitigate potential losses while using moving averages as part of a broader strategy.

By understanding and effectively applying these moving average strategies, traders can enhance their decision-making process and potentially increase their profitability in the ever-evolving crypto market.

Interpreting Moving Average Signals

Moving averages are powerful tools in cryptocurrency trading that help traders identify trends and potential entry or exit points. Interpreting the signals generated by moving averages can guide traders in making informed decisions, allowing them to capitalize on market movements effectively. Understanding how to interpret these signals is crucial for successful trading strategies.Analyzing moving average signals involves looking for specific patterns, particularly crossovers, which indicate shifts in market momentum.

These crossovers can create buy or sell signals, which traders often use to time their trades. For example, a bullish crossover occurs when a shorter-term moving average crosses above a longer-term moving average, suggesting a potential uptrend. Conversely, a bearish crossover happens when a shorter-term moving average crosses below a longer-term one, indicating a potential downtrend.

Moving Average Crossovers and Implications

Moving average crossovers serve as critical signals for traders. Here are some key points to consider when interpreting these movements:

Bullish Crossover

This occurs when the 50-day moving average crosses above the 200-day moving average. Traders see this as a sign of a potential uptrend, often referred to as a “golden cross.”

Bearish Crossover

This happens when the 50-day moving average crosses below the 200-day moving average, signaling a potential downtrend known as a “death cross.”

Timeframe Considerations

Different timeframes can yield varying signals. A short-term trader may focus on 10-day and 50-day moving averages, while long-term investors might prioritize 50-day and 200-day averages.

Confirmation

It is essential to seek confirmation from other technical indicators or price action to validate the signals generated by moving averages. Relying solely on moving averages can lead to false signals.While moving averages can provide valuable insights, traders should be cautious about potential pitfalls in interpreting these signals. The following points Artikel common challenges:

- Lagging Nature: Moving averages are lagging indicators, meaning they react to price movements rather than predict them. This delay can result in missed opportunities.

- Whipsaw Effect: In volatile markets, prices can swing rapidly, leading to false crossovers and erratic signals.

- Over-reliance on Signals: Traders may become overly dependent on moving averages, neglecting other important indicators and market conditions.

- Changing Market Conditions: What worked in one market phase may not work in another. Constantly adapting strategies to current conditions is essential.

- Inaccuracies with Historical Data: Relying solely on historical moving averages can lead to misleading signals, particularly in a rapidly changing market like cryptocurrency.

Combining Moving Averages with Other Indicators

Source: youglish.com

Utilizing moving averages in cryptocurrency trading is significantly enhanced when they are combined with other technical indicators. This approach allows traders to validate signals and make more informed decisions, ultimately increasing the likelihood of successful trades.The effectiveness of moving averages can be amplified when paired with various indicators that provide additional insights into market trends and price movements. This synergy helps traders confirm potential entry and exit points, manage risk, and improve the overall strategy.

Complementary Indicators

When merging moving averages with other technical indicators, several options stand out for their effectiveness. Below are some key indicators that work well with moving averages:

Relative Strength Index (RSI)

This momentum oscillator measures the speed and change of price movements, helping to identify overbought or oversold conditions in the market.

Bollinger Bands

These bands consist of a middle band (the moving average) and two outer bands, which represent standard deviations. They help visualize market volatility and potential price reversals.

MACD (Moving Average Convergence Divergence)

This trend-following momentum indicator shows the relationship between two moving averages of a security’s price, helping to identify potential buy and sell signals.

Volume Indicators

Indicators such as On-Balance Volume (OBV) or Volume Moving Average can provide insights into the strength of price movements alongside moving averages. Utilizing these indicators in conjunction with moving averages can enhance decision-making capabilities. Below is a comparative table highlighting their effectiveness:

| Indicator | Complement to Moving Averages | Effectiveness |

|---|---|---|

| Relative Strength Index (RSI) | Identifies overbought/oversold conditions. | High |

| Bollinger Bands | Indicates volatility and potential reversals. | Medium |

| MACD | Signals trend changes and momentum. | High |

| Volume Indicators | Confirms strength of price movements. | Medium |

Incorporating these indicators into your trading strategy alongside moving averages can yield more robust trading signals and better risk management practices. Traders can observe how these indicators interact to make well-informed decisions on when to enter or exit positions.

Real-world Case Studies

Many successful traders in the crypto space have leveraged moving averages to create effective trading strategies. By analyzing case studies where moving averages played a crucial role, we can glean insights that may benefit aspiring traders. These examples highlight not only the application of moving averages but also the outcomes achieved through different trading strategies.One prominent case involved a trader who utilized the 50-day and 200-day moving averages to determine the market trend for Bitcoin.

This trader observed that when the 50-day moving average crossed above the 200-day moving average, it indicated a bullish trend. This specific crossover, known as a “golden cross,” provided a signal for entering long positions in Bitcoin. The trader executed a trade when this crossover occurred, purchasing Bitcoin at $10,000. As the price surged to $12,000 shortly after, the trader capitalized on a 20% profit.

Successful Trade Examples

Analyzing successful trades that incorporated moving averages reveals valuable lessons. Below are examples showcasing effective strategies and their respective outcomes:

- Ethereum Trade by Trader X: Trader X employed a 20-day exponential moving average (EMA) alongside a 50-day simple moving average (SMA). Upon observing a bullish crossover, they initiated a buy order at $2,500. After holding for a month, Ethereum reached $3,000, resulting in a 20% gain.

- Ripple Trade by Trader Y: Trader Y used the 100-day moving average to identify a bearish trend in Ripple. By waiting for the price to drop below the 100-day MA, they shorted Ripple at $1.50. When the price fell to $1.20, they closed the position, achieving a profit of 20%.

- Litecoin Trade by Trader Z: Focusing on the 200-day moving average, Trader Z identified a long-term bullish trend. They bought Litecoin at $150, and as the price rose to $200 over several weeks, they secured a 33% profit. The trader emphasized patience and adherence to the moving average signals.

The key lessons from these case studies revolve around the importance of understanding market trends and the discipline to follow moving average signals. Successful traders emphasize the need to remain patient and avoid emotional decision-making, relying on the data provided by moving averages to inform their trading strategies. Additionally, these examples highlight the potential risks of trading when the market is volatile, reminding traders to consider their risk management strategies.

Common Mistakes and Misconceptions

When using moving averages in crypto trading, many traders fall into common pitfalls that can hinder their trading success. Understanding these mistakes and misconceptions is crucial for making informed decisions and maximizing the effectiveness of moving averages in your trading strategy. Recognizing that moving averages are not foolproof indicators can help traders adjust their approaches and avoid unnecessary losses.One prevalent misconception is the belief that moving averages are always effective, particularly in volatile markets.

While they can provide insights into trends, they are not infallible and can generate false signals during rapid price fluctuations. Traders often overlook the importance of context when interpreting moving average signals, leading to rash decisions that may not align with market conditions.

Common Mistakes in Using Moving Averages

Many traders inadvertently make errors that can undermine their trading results. To navigate these challenges effectively, here are some common mistakes to avoid:

- Relying solely on moving averages without considering market conditions can lead to incorrect interpretations of price movements.

- Using inappropriate timeframes for moving averages may result in signals that do not align with trading goals, whether short-term or long-term.

- Ignoring other technical indicators can cause traders to miss out on important confirmations or signals that could lead to better decision-making.

- Failing to adjust moving averages according to changing market conditions can render them less effective, especially in highly volatile environments.

- Overtrading based on moving average crossovers without proper risk management can increase exposure to losses.

- Misinterpreting the direction and strength of trends indicated by moving averages can lead to poorly timed entries and exits.

By steering clear of these mistakes, traders can enhance their understanding of moving averages and improve their overall trading strategies. Awareness of these pitfalls empowers traders to make more informed decisions and better navigate the complexities of the crypto market.

“Understanding the context and limitations of moving averages is key to leveraging them effectively in trading.”

Final Thoughts

Source: pxhere.com

In summary, mastering how to use moving averages in crypto can significantly elevate your trading game. By integrating these averages into your strategy, you can better gauge market movements and make strategic decisions that align with your trading goals. Remember, while moving averages are powerful tools, it’s essential to combine them with other indicators and maintain a keen awareness of market conditions to navigate the ever-changing landscape of cryptocurrency trading.

Q&A

What are moving averages in cryptocurrency?

Moving averages are statistical calculations that analyze data points by creating averages over specific time intervals, helping traders identify trends in cryptocurrency prices.

Why are moving averages important for traders?

They help traders smooth out price data to identify the direction of the trend, making it easier to spot potential entry and exit points.

How do I choose the right moving average for my strategy?

The choice depends on your trading style; shorter moving averages are better for short-term trading, while longer ones suit long-term trends.

Can moving averages guarantee successful trades?

No, while they provide insights into market trends, they should be used in conjunction with other indicators and analysis methods for better risk management.

What are the limitations of moving averages?

They can lag behind price movements and may result in false signals, especially in volatile markets, so caution is advised.