How to Use Fibonacci Retracement in Crypto Trading

How to Use Fibonacci Retracement in Crypto Trading opens the door to a fascinating world where mathematics meets market behavior. This powerful tool, derived from the age-old Fibonacci sequence, has gained traction among traders seeking to predict potential price reversals in cryptocurrencies. By understanding its principles and applications, traders can enhance their decision-making process and harness the volatility of the crypto space more effectively.

Fibonacci retracement is not just about numbers; it’s about recognizing patterns and potential turning points within chaotic market trends. As we delve deeper into its significance, you’ll discover how these levels can guide your trading strategies, aligning risk management with technical analysis to capture lucrative opportunities.

Introduction to Fibonacci Retracement

Source: pxhere.com

Fibonacci retracement is a widely used technical analysis tool that helps traders identify potential reversal levels in the financial markets. It is based on the Fibonacci sequence—a mathematical sequence where each number is the sum of the two preceding ones. This concept has been embraced by traders due to its ability to predict market movements and provide insights into potential points of support and resistance.The historical roots of Fibonacci retracement can be traced back to the early 1200s when the Italian mathematician Leonardo of Pisa, better known as Fibonacci, introduced the sequence to the Western world.

The sequence itself starts with 0 and 1, and each subsequent number is derived by adding the two previous numbers, resulting in 0, 1, 1, 2, 3, 5, 8, 13, and so on. In trading, these numbers translate into key levels that traders observe on price charts. The ratio of these numbers, particularly 61.8%, 38.2%, and 23.6%, are identified as significant retracement levels, indicating where price corrections are likely to occur after a trend.

Application of Fibonacci Sequence in Financial Markets

The Fibonacci sequence finds practical application in various aspects of financial trading, primarily through Fibonacci retracement levels. By plotting these levels on a price chart, traders can identify potential areas where the price might reverse. The following key levels are commonly used in the analysis:

- 23.6% Level: This level indicates a shallow correction and is often seen in strong trends.

- 38.2% Level: A moderate retracement that can signal a potential reversal point.

- 50% Level: While not a Fibonacci number, this level is widely accepted as a significant psychological barrier.

- 61.8% Level: Considered the “golden ratio,” this level is crucial for traders assessing strong reversal points.

- 76.4% Level: A deeper retracement level that indicates a more substantial pullback before a continuation.

Traders utilize these levels by drawing horizontal lines on the chart at the identified retracement percentages after a significant price movement. For instance, after an upward trend, a trader may observe a price pullback towards the 38.2% level, where buying pressure could emerge, signaling a potential continuation of the upward trend. Conversely, if the price penetrates these key levels significantly, it may indicate a reversal of the prevailing trend.

“Fibonacci retracement levels serve as a roadmap for traders, guiding them in their decision-making process by highlighting areas where price may consolidate or reverse.”

Overall, Fibonacci retracement not only provides a systematic approach to trading but also bridges the gap between mathematical theory and practical market application. Traders who integrate these levels into their strategy can enhance their understanding of market dynamics and improve their decision-making process.

Understanding Fibonacci Levels

Fibonacci retracement levels are essential tools for traders seeking to identify potential support and resistance levels in the price movements of cryptocurrencies. By leveraging these mathematical ratios derived from the Fibonacci sequence, traders can make more informed decisions regarding entry and exit points, enhancing their trading strategies. The main Fibonacci levels commonly used in trading include the following percentages: 23.6%, 38.2%, 50%, 61.8%, and 100%.

Each of these levels is based on specific Fibonacci ratios, providing traders with critical insights into market behavior.

Main Fibonacci Levels in Trading

To comprehend the significance of Fibonacci levels, it’s vital to understand what each percentage represents:

- 23.6%: This level is often considered the first line of potential support or resistance. It is derived by dividing one number in the Fibonacci sequence by the number two places to the right, helping to identify minor retracement levels.

- 38.2%: This level indicates a deeper retracement and is calculated by dividing one number in the sequence by the number that follows it. It often serves as an important level for price action, hinting at stronger market reversals.

- 50%: Although not an official Fibonacci level, the 50% retracement is widely used among traders. It acknowledges that the market retraces about half of the previous price movement, thereby serving as a psychological level of support or resistance.

- 61.8%: This key level, known as the “golden ratio,” is derived by dividing a number in the Fibonacci sequence by the number that follows it. It is one of the most significant levels for predicting reversals and often highlights strong support or resistance.

- 100%: This level signifies the complete retracement of the previous price movement. Traders use this to identify potential continuation of trends after a full retracement.

Calculating Fibonacci levels on a price chart involves identifying a significant price movement, typically a rally or a decline, and applying the Fibonacci tool to determine retracement levels. Here’s a straightforward procedure for drawing Fibonacci retracement levels on a crypto trading chart:

Step-by-Step Procedure for Drawing Fibonacci Retracement Levels

Begin by selecting a recent significant high and low on your price chart. This will form the basis for your Fibonacci retracement tool.

- Identify the Swing High and Swing Low: Locate the highest point (swing high) and the lowest point (swing low) of your chosen price movement.

- Use the Fibonacci Tool: Most trading platforms have a built-in Fibonacci retracement tool. Select this tool from the drawing options.

- Draw the Levels: Click on the swing low and drag the line to the swing high for an upward movement, or vice versa for a downward movement. This action will automatically generate the Fibonacci levels on your chart.

- Observe the Levels: Once drawn, the Fibonacci levels will appear as horizontal lines on the chart. Monitor these levels closely as potential areas of support and resistance during price movements.

By integrating these Fibonacci levels into your trading strategy, you can enhance your technical analysis and improve your chances of making successful trades in the highly volatile crypto market.

Application of Fibonacci Retracement in Crypto Trading

Source: pxhere.com

Applying Fibonacci retracements in crypto trading is a powerful technique that can help traders identify potential reversal points in the market. By understanding how to implement this tool effectively, traders can enhance their decision-making process and improve their chances of entering profitable positions. This methodology hinges on the mathematical principles behind Fibonacci sequences, translating them into actionable insights for trading cryptocurrencies.In practice, the application of Fibonacci retracement involves plotting key Fibonacci levels on a price chart after a significant price movement.

This is done by taking the high and low points of a recent price swing and applying the Fibonacci ratios—commonly 23.6%, 38.2%, 50%, 61.8%, and 76.4%. These levels serve as potential support and resistance areas where the price might reverse or consolidate. By closely monitoring price action around these levels, traders can make informed decisions regarding entry and exit points.

Combining Fibonacci Retracement with Other Technical Indicators

Integrating Fibonacci retracement levels with other technical indicators is crucial for enhancing the effectiveness of trading strategies. By using multiple indicators, traders can confirm potential reversal points and increase the reliability of their trades. For example, pairing Fibonacci levels with moving averages can provide insight into overall market trends, while oscillators such as the Relative Strength Index (RSI) can indicate overbought or oversold conditions.When combining these tools, traders can develop a more comprehensive view of the market situation.

For instance, if the price approaches the 61.8% Fibonacci level and simultaneously shows a bullish divergence on the RSI, this convergence of signals might suggest a stronger likelihood of a price reversal. This synergy between different indicators helps traders to filter out false signals and improve their risk management strategies.

Advantages and Limitations of Using Fibonacci Retracement

Understanding the advantages and limitations of Fibonacci retracement as a trading tool is essential for effective crypto trading. Below is a table summarizing the key points:

| Advantages | Limitations |

|---|---|

| Provides clear levels for potential reversals, enabling traders to set entry and exit points easily. | Fibonacci levels are subjective; different traders may draw them differently, leading to varying interpretations. |

| Helps identify strong support and resistance areas, enhancing trade planning. | May not always accurately predict market behavior; markets can be influenced by numerous external factors. |

| Can be used in conjunction with other indicators for a more robust trading strategy. | Relying solely on Fibonacci retracement can lead to missed opportunities if market conditions change rapidly. |

Trading Strategies Using Fibonacci Retracement

Fibonacci retracement levels are invaluable tools for traders in the cryptocurrency market, providing insights into potential support and resistance areas. By incorporating Fibonacci levels into a trading strategy, traders can enhance their decision-making process, improving their chances of success in a volatile environment. This section delves into developing a comprehensive trading strategy that effectively utilizes Fibonacci retracement, alongside risk management techniques and common pitfalls to avoid.

Developing a Trading Strategy with Fibonacci Levels, How to Use Fibonacci Retracement in Crypto Trading

To create a robust trading strategy, it is essential to identify key Fibonacci levels on your charts. Start with the most recent significant price movements, marking the high and low points to establish the Fibonacci retracement levels. These levels typically include 23.6%, 38.2%, 50%, 61.8%, and 76.4%. Once the levels are set, observe how the price interacts with these points.

A potential strategy could involve entering a trade when the price approaches one of these retracement levels backed by other technical indicators, such as moving averages or RSI (Relative Strength Index), which can confirm the trend’s momentum.Risk management is crucial when utilizing Fibonacci retracement levels in your trades. It involves setting stop-loss orders just below the Fibonacci level when entering a long position and just above when taking a short position.

This tactic allows for minimizing losses in case the market goes against the expected direction.

Risk Management Techniques

Effective risk management can significantly enhance the sustainability of your trading endeavors. Here are some strategies to consider:

- Position Sizing: Determine the size of your trades based on your overall capital and risk tolerance. A common guideline is to risk only 1-2% of your trading capital on any single trade.

- Use of Stop-Loss Orders: Always set stop-loss orders in accordance with Fibonacci levels. This ensures that you exit a trade if the price moves against you significantly, protecting your capital.

- Regularly Adjust Your Strategy: Market conditions change; thus, it is essential to periodically review and adjust your strategy based on market performance and the effectiveness of your Fibonacci levels.

- Maintain a Trading Journal: Keeping a detailed log of trades will help you identify patterns in your trading behavior, evaluate the effectiveness of your strategy, and refine your approach over time.

Common Mistakes with Fibonacci Retracement

When trading with Fibonacci retracement, it’s vital to recognize common mistakes that can lead to unfavorable outcomes. Below is a list of frequent pitfalls and tips for avoiding these errors:

- Ignoring Other Indicators: Relying solely on Fibonacci levels without considering other technical indicators can result in missed opportunities or false signals. Ensure a comprehensive approach by integrating multiple indicators.

- Misplacing Fibonacci Levels: Accurate placement of Fibonacci retracement levels is critical. Double-check the high and low points used for calculations, as inaccuracies can lead to misleading conclusions.

- Overtrading on Minor Retracements: Some traders jump at every minor retracement, leading to overtrading. Focus on significant retracement levels and high-impact price actions for more reliable trading signals.

- Failing to Adapt to Market Conditions: Markets are dynamic, and what worked in the past may not hold true in the future. Be prepared to adjust your strategies as market conditions evolve.

Real-World Examples of Fibonacci Retracement in Action

Fibonacci retracement levels have been utilized by traders in various markets, including cryptocurrencies, to identify potential reversal points and make informed trading decisions. This section explores real-world examples where these levels have played a crucial role in successful trades, showcasing the effectiveness of the tool across different market conditions and popular cryptocurrencies.

Case Study: Bitcoin’s Surge in 2021

In early 2021, Bitcoin experienced significant growth, reaching an all-time high of nearly $64,000. During this bullish phase, Fibonacci retracement levels were instrumental in helping traders identify potential pullbacks. After the peak, Bitcoin retraced to the 61.8% level, providing a critical support zone for traders to enter again. This level was particularly effective due to the strong market sentiment around Bitcoin, along with the influx of institutional investment.

The subsequent bounce off this level led to another rally, confirming the reliability of Fibonacci retracement in trending markets.

Case Study: Ethereum’s Volatility in 2020

Ethereum exhibited notable price movements throughout 2020, especially during the DeFi boom. Traders utilized Fibonacci retracement levels after Ethereum reached its peak in August at approximately $490. The asset corrected sharply, retracing to the 50% Fibonacci level around $360. This retracement occurred amidst broader market volatility and regulatory discussions surrounding DeFi projects. The 50% level acted as a support point, allowing traders to capitalize on the recovery when Ethereum moved back towards its all-time highs.

Comparison of Different Cryptocurrencies’ Responses

Different cryptocurrencies exhibit varied responses to Fibonacci retracement levels, influenced by their market conditions. Here’s a comparison of how a few major cryptocurrencies interacted with these levels during specific periods:

| Cryptocurrency | Fibonacci Level Tested | Market Condition | Outcome |

|---|---|---|---|

| Bitcoin | 61.8% | Bullish Trend | Strong Rebound |

| Ethereum | 50% | High Volatility | Significant Recovery |

| Ripple (XRP) | 38.2% | Regulatory Fears | Partial Bounce |

| Litecoin (LTC) | 23.6% | Stable Growth | Gradual Increase |

These examples illustrate how diverse market conditions and sentiment influence the effectiveness of Fibonacci retracement levels across various cryptocurrencies. Each cryptocurrency reacts differently based on external factors, trading volume, and investor behavior, showcasing the nuanced application of Fibonacci analysis in crypto trading. Market participants can thus incorporate these insights into their trading strategies for more informed decisions.

Advanced Techniques and Common Misconceptions: How To Use Fibonacci Retracement In Crypto Trading

In the world of cryptocurrency trading, mastering Fibonacci retracement can be a game-changer, but understanding its advanced techniques and addressing common misconceptions is equally vital. This section delves deeper into enhancing your trading strategy with Fibonacci levels while clearing up some prevalent myths that might hinder your trading success.

Advanced Techniques to Enhance Fibonacci Usage

Incorporating advanced techniques can significantly improve the effectiveness of Fibonacci retracement in trading. Some of these techniques include:

- Combining Fibonacci with Other Indicators: Utilizing Fibonacci retracement in conjunction with other technical indicators, such as Moving Averages or RSI (Relative Strength Index), can provide additional confirmation for potential price action at key Fibonacci levels. This convergence of signals often increases the reliability of trading decisions.

- Using Multiple Time Frames: Analyzing Fibonacci levels across different time frames can offer a more comprehensive view. For example, a Fibonacci retracement on a daily chart may reveal a significant support level, while a smaller time frame might show a potential reversal point, allowing traders to time their entries or exits more effectively.

- Integrating Fibonacci Extensions: Beyond retracement levels, Fibonacci extensions can project potential price targets. By identifying extension levels in conjunction with retracement levels, traders can set more informed profit-taking strategies, thus optimizing their risk-to-reward ratios.

- Adjusting Levels for Volatility: In the crypto market, volatility can skew standard Fibonacci levels. Adapting the levels based on the average price swings of a cryptocurrency can yield more accurate support and resistance points tailored to the asset’s price behavior.

Common Misconceptions Surrounding Fibonacci Retracement

Despite the popularity of Fibonacci retracement in trading, several misconceptions persist that can misguide traders. Addressing these is crucial for developing a sound trading approach.

- Fibonacci Levels Guarantee Price Reversals: One common myth is that Fibonacci levels will always lead to a reversal or bounce. While these levels indicate areas of interest, price movements can still break through them, and traders must remain cautious and consider other factors.

- Fibonacci is Only for Technical Traders: Some believe that Fibonacci is solely a tool for technical analysis. In reality, it can be effectively integrated with fundamental analysis to provide a more holistic view of the market and inform trading strategies.

- All Traders Interpret Fibonacci Levels the Same Way: Each trader has unique experiences and preferences, leading to varying interpretations of Fibonacci levels. Understanding that different traders may react differently to these levels is vital for anticipating market movements.

Psychological Factors Influencing Fibonacci Interpretation

The psychological aspect of trading plays a significant role in how Fibonacci levels are perceived and acted upon by traders. Traders often fall into the trap of herd mentality when approaching Fibonacci levels, leading to emotional decision-making rather than rational analysis. For instance, if a significant number of traders are buying at a particular Fibonacci retracement level, others may feel pressured to do the same out of fear of missing out (FOMO).

This can create false breakouts or exaggerated price movements that deviate from typical Fibonacci behavior.Moreover, confirmation bias can affect how traders interpret Fibonacci levels. When traders have a preconceived notion about market direction, they may selectively focus on levels that support their beliefs while ignoring contrary signals. This can lead to poor decision-making and potential losses.Understanding these psychological factors is essential for refining one’s trading strategy.

By recognizing their own biases and the potential influence of fellow traders, individuals can approach Fibonacci retracement with a clearer mindset, making more informed and disciplined trading choices.

Last Word

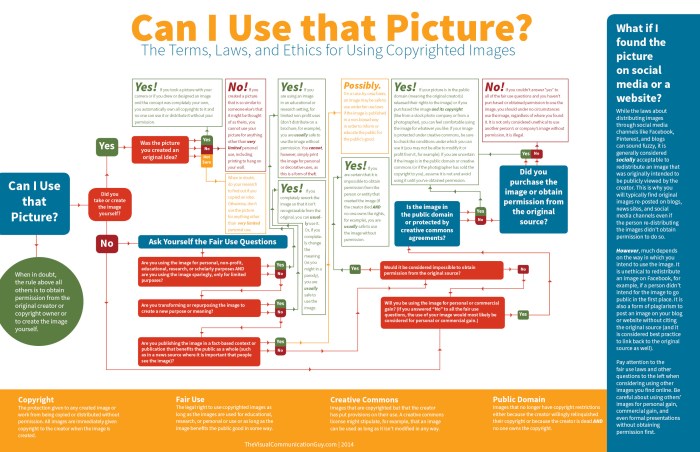

Source: thevisualcommunicationguy.com

In summary, mastering Fibonacci retracement in crypto trading can elevate your trading game, offering insights that blend technical analysis with strategic execution. By utilizing this tool effectively, you can identify key levels of support and resistance, allowing for better-informed trading decisions. As you continue your trading journey, remember that while Fibonacci retracement is a powerful ally, combining it with other indicators and sound risk management will lead you to greater success in the ever-evolving crypto market.

Helpful Answers

What is Fibonacci retracement?

Fibonacci retracement is a technical analysis tool that identifies potential support and resistance levels using horizontal lines based on Fibonacci numbers.

How do I draw Fibonacci retracement levels on a chart?

To draw Fibonacci retracement levels, select a significant price movement on the chart, use the Fibonacci tool, and plot it from the high to the low (or vice versa) of that movement.

Can Fibonacci retracement be used in all markets?

Yes, Fibonacci retracement can be applied in various markets, including stocks, forex, and cryptocurrencies, as long as the asset exhibits price trends.

What are the main Fibonacci levels to consider?

The primary Fibonacci levels to watch are 23.6%, 38.2%, 50%, 61.8%, and 100%, which indicate potential reversal points.

How does market psychology affect Fibonacci retracement?

Market psychology plays a significant role as traders often react to Fibonacci levels, creating self-fulfilling prophecies where price reversals occur at these points.