Best Crypto Trading Strategies for Consistent Profit

Best Crypto Trading Strategies for Consistent Profit is a crucial topic for anyone looking to navigate the complex world of cryptocurrency trading successfully. With the market’s volatility, having a solid trading strategy can mean the difference between consistent gains and devastating losses. This guide will explore essential strategies, from technical and fundamental analysis to risk management and performance assessment, ensuring traders are equipped to make informed decisions.

Understanding the various trading approaches, such as day trading, swing trading, and long-term investing, is essential for formulating a strategy. This overview sets the stage for diving deeper into the methodologies and tools that can help traders achieve long-term success in the ever-evolving crypto landscape.

Understanding Crypto Trading Strategies: Best Crypto Trading Strategies For Consistent Profit

In the rapidly evolving world of cryptocurrency, having a solid trading strategy is essential for navigating the market successfully. Crypto trading strategies are methodologies traders use to make informed decisions, minimize risks, and maximize returns. Understanding these strategies allows traders to adapt to market changes and achieve consistent profits.At its core, crypto trading strategies encompass various approaches to buying and selling digital currencies.

A well-defined strategy is significant for long-term success as it helps traders remain disciplined, avoid impulsive decisions, and manage their investments effectively. Without a strategy, traders may find themselves reacting to market volatility rather than making calculated decisions based on analysis.

Types of Trading Strategies

Different trading strategies cater to various timeframes and risk appetites. Understanding these distinctions is crucial for choosing the right approach to achieve trading goals.

- Day Trading: This strategy involves making multiple trades within a single day, aiming to capitalize on short-term price movements. Day traders often use technical analysis to identify potential entry and exit points and leverage small fluctuations in price to secure quick profits.

- Swing Trading: Swing traders hold positions for several days or weeks, aiming to profit from expected price swings. This approach requires a balance of technical and fundamental analysis, allowing traders to capture larger price movements while avoiding the stress of day trading.

- Long-Term Investing: Long-term investors focus on holding cryptocurrencies for extended periods, often months or years, based on fundamental analysis and market potential. This strategy is less concerned with short-term price fluctuations and more focused on the overall growth of the asset over time.

Understanding the nuances of each strategy allows traders to align their methods with their financial goals, risk tolerance, and market outlook. By choosing the appropriate trading strategy, investors can enhance their potential for consistent profitability in the dynamic realm of cryptocurrency trading.

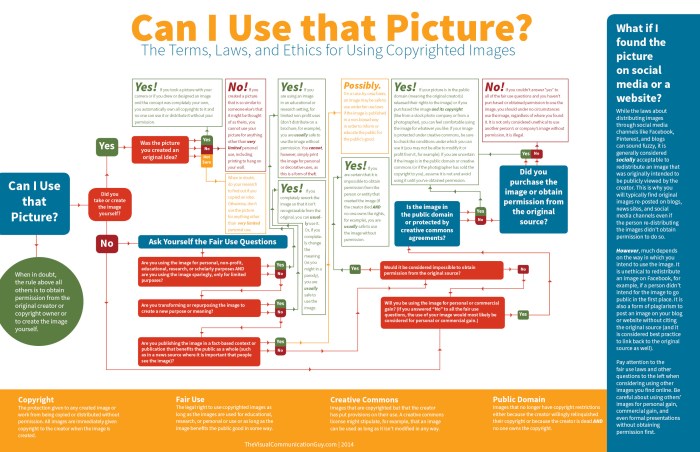

Technical Analysis in Crypto Trading

Source: alamy.com

Technical analysis is a crucial component of crypto trading that allows traders to evaluate digital assets and make informed decisions based on statistical trends and historical price movements. By studying market patterns, traders can identify potential entry and exit points, enabling them to maximize profit potential while minimizing risk. This approach primarily relies on historical price data and trading volume, making it essential for anyone looking to navigate the volatile world of cryptocurrencies effectively.Understanding technical analysis encompasses various key indicators and tools that assist traders in interpreting market trends.

Among the many methodologies available, some of the most widely used indicators include the Moving Averages (MA), Relative Strength Index (RSI), and Bollinger Bands. Each of these indicators serves a unique purpose, providing insights into market momentum, overbought or oversold conditions, and volatility. Furthermore, visual representations like candlestick charts are instrumental in conveying price movement over specific periods, making them easy to read and analyze.

Key Technical Indicators Used in Crypto Trading

Utilizing the right technical indicators can significantly enhance a trader’s ability to forecast market movements. Below are some key indicators, along with brief descriptions of their functions:

- Moving Averages (MA): A moving average smooths out price data by creating a constantly updated average price. The two most common types are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA), with the latter giving more weight to recent prices and thus reacting more quickly to price changes.

- Relative Strength Index (RSI): This momentum oscillator measures the speed and change of price movements. It ranges from 0 to 100, with readings above 70 indicating overbought conditions and below 30 suggesting oversold conditions, helping traders identify potential reversals.

- Bollinger Bands: This indicator consists of a middle band (SMA) and two outer bands that represent standard deviations from the SMA. It helps traders identify volatility and potential price breakout points based on the distance between the bands.

Reading and Interpreting Candlestick Charts

Candlestick charts are invaluable tools for traders, providing visual insights into price action over time. Each candlestick represents a specific time frame and comprises four critical price points: open, high, low, and close. The body of the candlestick is formed between the opening and closing prices, while the wicks (or shadows) indicate the high and low for that time period.To effectively read candlestick charts, it is essential to recognize patterns that signal potential future price movements.

Some common patterns include:

- Doji: This pattern occurs when the opening and closing prices are virtually equal, indicating indecision in the market and potentially signaling a reversal.

- Hammer: A hammer pattern has a small body at the top of the range with a long lower shadow, suggesting that buyers are starting to gain control after a price decline.

- Engulfing Pattern: This pattern consists of two candles, where a smaller candle is followed by a larger candle that completely engulfs the previous one, indicating a potential reversal in trend.

Guidelines for Setting Up and Using Trading Tools

To enhance trading effectiveness, it’s beneficial to set up key technical tools properly. Here are guidelines for using Moving Averages and RSI effectively:

- Setting Up Moving Averages: Traders should select appropriate time frames based on their trading strategy. For short-term trading, a combination of the 9-day EMA and 21-day EMA can be used. A bullish signal occurs when the shorter EMA crosses above the longer EMA, while a bearish signal is indicated by the opposite crossover.

- Utilizing RSI: Set the RSI to a 14-day period for a standard approach. Traders should consider entering positions when the RSI crosses the 30 or 70 thresholds, aligning with the overbought and oversold signals. It is crucial to confirm RSI signals with other indicators to enhance decision-making.

“Technical analysis allows traders to make informed decisions based on statistical trends and historical price movements.”

Fundamental Analysis for Crypto Trading

Source: primanyc.net

In the rapidly evolving world of cryptocurrency, fundamental analysis plays a crucial role in guiding traders toward making informed decisions. Unlike technical analysis, which focuses on price movements and trading volume, fundamental analysis taps into the underlying factors that influence the value of cryptocurrencies. By understanding these elements, traders can assess the potential for growth and investment.Fundamental analysis in the crypto market involves evaluating a project’s technology, team, market demand, and competitive landscape.

This analysis helps traders determine whether a cryptocurrency is undervalued or overvalued based on its intrinsic value and overall market conditions. By taking a comprehensive approach to analyzing assets, traders improve their chances of making profitable trades.

Methods for Evaluating Cryptocurrency Projects

Evaluating cryptocurrency projects requires a structured approach to understand their potential and risks. Below are key methods that can be employed:

1. Whitepaper Review

The whitepaper is a fundamental document that Artikels the technology, purpose, and vision of a cryptocurrency. Analyzing the whitepaper helps identify the uniqueness of the project, its use cases, and the problem it aims to solve.

2. Team Assessment

Investigating the backgrounds of the founding team and developers is essential. A strong team with relevant experience and a successful track record often indicates a higher probability of project success.

3. Community Engagement

The level of community involvement can be a significant indicator of a project’s potential. Active communities on platforms like Telegram, Reddit, and Twitter can foster support and drive adoption.

4. Partnerships and Collaborations

Evaluating existing partnerships can provide insight into a project’s credibility and market acceptance. Collaborations with reputable firms or other blockchain projects often enhance trust and visibility.

5. Market Position and Competition

Understanding where a cryptocurrency stands in relation to its competitors is crucial. Analyzing market share, user adoption, and technological advantages can highlight its potential for growth.

6. Regulatory Environment

The regulatory landscape can greatly affect cryptocurrency projects. Staying informed about relevant laws, compliance issues, and potential restrictions is vital for assessing long-term viability.

Reliable Sources for Tracking Market News and Trends

Staying updated with credible sources is essential for effective fundamental analysis in the crypto space. Here are some reliable platforms to consider:

CoinMarketCap

This site not only provides pricing data and market capitalization but also offers news updates and information on various cryptocurrencies, making it a comprehensive resource for traders.

CryptoSlate

A dedicated news platform that covers the latest developments, trends, and insights in the cryptocurrency market, CryptoSlate is invaluable for traders aiming to stay informed about the ecosystem.

CoinDesk

Known for its reliable journalism, CoinDesk offers in-depth articles, analysis, and reports on market trends, regulatory changes, and technological advancements.

Following industry leaders, developers, and influential figures in the crypto community can provide real-time updates and insights into market dynamics.

Medium

Many blockchain projects publish articles on Medium, providing insights directly from the sources. This platform is a useful tool for understanding project developments and community sentiment.

Subreddits like r/CryptoCurrency and r/Bitcoin can serve as forums for discussions, news sharing, and community engagement, providing diverse perspectives on market trends and project evaluations.By utilizing these methods and sources, traders can enhance their fundamental analysis skills, leading to more informed investment decisions in the unpredictable world of cryptocurrency.

Risk Management Techniques

In the world of cryptocurrency trading, managing risk is just as crucial as identifying profitable opportunities. Effective risk management techniques can help traders protect their capital, minimize losses, and maintain a sustainable trading strategy. By implementing robust risk management strategies, traders can navigate the volatile crypto market more effectively and increase their chances of long-term success.One key facet of risk management in trading is the use of stop-loss and take-profit orders.

These tools allow traders to automate their exit points, safeguarding their investments from significant downturns and locking in profits when a favorable price level is reached. By setting a stop-loss order, a trader specifies the maximum loss they are willing to accept on a trade. Conversely, a take-profit order ensures that profits are realized once the price hits a predetermined level.

Stop-Loss and Take-Profit Orders

Stop-loss and take-profit orders play a significant role in risk management for cryptocurrency traders. These orders help traders define their risk tolerance and automate their trading process.

Stop-Loss Orders

A stop-loss order is a pre-defined price level at which a trader will automatically sell their asset to limit losses. For example, if a trader buys Bitcoin at $20,000 and places a stop-loss order at $18,500, the order will trigger a sale if the price drops to $18,500, thereby capping the loss at 7.5%. This mechanism allows traders to exit positions without emotionally reacting to price fluctuations.

Take-Profit Orders

A take-profit order allows traders to lock in profits when the price reaches a specific level. For instance, if a trader purchases Ethereum at $1,500 and sets a take-profit order at $1,800, the order will automatically execute a sale when Ethereum’s price hits $1,800. This approach helps in securing profits without the need for constant monitoring of the market.Implementing these orders helps traders maintain discipline and adhere to their overall trading plan, reducing the likelihood of making impulsive decisions based on market sentiment.

Position Sizing

Position sizing is a critical element of risk management that determines how much capital a trader allocates to a particular trade. Proper position sizing ensures that no single trade can significantly impact a trader’s overall account balance, thus preserving long-term viability in trading.The concept of position sizing revolves around the idea of risk per trade. A common guideline suggests risking only 1% to 2% of the trading capital on a single trade.

For example, if a trader has a capital of $10,000 and decides to risk 1% on a trade, they would allocate $100 for that trade. If the trade incurs a loss and the stop-loss is hit, only $100 would be lost, ensuring that the majority of capital remains intact for future trades.To determine the position size, traders can utilize the following formula:

Position Size = (Account Risk × Account Balance) / Trade Risk

Where:

- Account Risk is the percentage of the account you are willing to risk (e.g., 0.01 for 1%).

- Account Balance is the total capital available for trading.

- Trade Risk is the difference between the entry price and stop-loss price.

By carefully calculating position sizes and adhering to a strict risk management plan, traders can enhance their chances of achieving consistent profits while navigating the unpredictable nature of cryptocurrency markets.

Developing a Trading Plan

Creating a well-structured trading plan is essential for any crypto trader aiming for consistent profits. A trading plan Artikels the strategy, rules, and goals that guide trading decisions, ultimately leading to disciplined and informed trading practices. This structured approach helps traders remain focused and reduces emotional decision-making in the often volatile cryptocurrency market.

Comprehensive Structure for a Crypto Trading Plan

A thorough trading plan should cover several key components that align with the trader’s objectives and risk tolerance. Each section of the plan plays a critical role in shaping the trader’s approach to the market. Below are the primary elements to include in your trading plan:

- Market Analysis: This involves identifying the cryptocurrencies to trade, understanding market conditions, and analyzing potential trends based on historical data.

- Entry and Exit Strategies: Clearly define your criteria for entering and exiting trades, including specific price levels, indicators, or patterns that will trigger your actions.

- Risk Management: Set parameters for your risk exposure, including the percentage of your portfolio to risk on each trade, stop-loss placements, and maximum drawdown limits.

- Trade Size and Position Sizing: Determine how much capital you will allocate to each trade to ensure proper diversification and risk handling.

- Performance Evaluation: Establish metrics for evaluating the success of your trades, including win/loss ratios and return on investment (ROI).

Importance of Setting Clear Goals and Objectives

Setting clear goals and objectives is vital for maintaining focus and direction in your trading journey. Goals provide a benchmark for success and help to guide your decision-making process. Well-defined objectives allow traders to measure progress over time and adjust strategies accordingly. Here are a few reasons why clear goals are crucial:

- Motivation: Having specific, measurable goals encourages continuous improvement and keeps traders motivated to enhance their skills.

- Performance Tracking: Goals provide a framework for assessing performance, enabling traders to identify what works and what doesn’t.

- Decision Making: Goals and objectives act as a compass, helping traders remain focused during market fluctuations, thereby minimizing impulsive decisions.

Regular Review and Adjustment of the Trading Plan

The cryptocurrency market is dynamic, and as such, a trading plan should not be static. Regularly reviewing and adjusting your trading plan is essential for adapting to market changes and improving performance. This ongoing evaluation process ensures your strategies remain effective and relevant. Consider the following aspects during the review:

- Performance Analysis: Regularly assess your trading results against your goals to identify areas for improvement.

- Market Changes: Stay updated on market trends, news, and regulatory developments that may influence your trading strategy.

- Strategy Effectiveness: Evaluate whether your current strategies are yielding desired results and be open to modifying them if necessary.

“An effective trading plan is a living document that evolves with the trader’s experience and market conditions.”

Diversification in Crypto Trading

Diversification is a crucial strategy in cryptocurrency trading that helps traders manage risks while seeking consistent profits. By spreading investments across various assets, traders can potentially shield their portfolio from the volatility that often characterizes the crypto market. This approach ensures that the performance of one asset does not disproportionately influence the overall portfolio.Diversification can significantly mitigate risks in crypto trading by reducing the impact of adverse price movements.

When a trader invests in multiple cryptocurrencies or related asset classes, the poor performance of one asset can be offset by the better performance of another. This strategy not only lowers the overall volatility of the portfolio but also enhances the potential for capital growth over time. Given the unpredictable nature of the crypto market, having a diversified portfolio is a strategic necessity.

Different Asset Classes within the Cryptocurrency Market

In order to effectively diversify a cryptocurrency portfolio, one must understand the different asset classes available in the market. Diversification can be achieved by investing in various categories of cryptocurrencies, each with unique characteristics and risk profiles. Here are key asset classes to consider:

- Major Cryptocurrencies: These include well-established coins like Bitcoin (BTC) and Ethereum (ETH), which typically have larger market capitalizations and are more stable compared to altcoins.

- Altcoins: This category comprises a wide range of alternative coins, often with innovative technologies and potential for high returns, albeit with higher risk.

- Stablecoins: Cryptocurrencies pegged to stable assets like the US Dollar (e.g., Tether (USDT), USD Coin (USDC)) that provide price stability and can serve as a safe haven during market volatility.

- Tokens: Utility and governance tokens that are associated with specific projects or platforms, such as Chainlink (LINK) or Uniswap (UNI), often represent unique investment opportunities.

- DeFi Assets: Decentralized Finance (DeFi) tokens, which enable various financial services without intermediaries, can offer significant growth opportunities and diversification benefits.

To illustrate the benefits of diversification, consider the following comparative table that Artikels diversified portfolios versus concentrated portfolios:

| Portfolio Type | Characteristics | Risk Level | Potential Returns |

|---|---|---|---|

| Diversified Portfolio | Invests in various cryptocurrencies across multiple asset classes. | Lower risk due to asset variety; less impacted by individual asset volatility. | Moderate returns; benefits from multiple growth opportunities. |

| Concentrated Portfolio | Focuses investment on a few selected cryptocurrencies. | Higher risk; significant fluctuations based on selected assets’ performance. | Potential for high returns if selected assets perform well, but also greater risk of losses. |

By carefully selecting a mix of different asset classes, traders can create a balanced portfolio that takes advantage of the opportunities in the cryptocurrency market while managing their exposure to risk effectively.

Common Mistakes to Avoid in Crypto Trading

Crypto trading can be a thrilling yet risky venture. Many traders, especially beginners, often fall into common traps that can lead to significant losses. Understanding these pitfalls and learning how to avoid them is crucial for achieving consistent profit in the volatile world of cryptocurrencies. This section will Artikel frequently encountered mistakes, the psychological barriers that can hinder decision-making, and effective strategies for maintaining discipline and emotional control.

Frequent Pitfalls in Crypto Trading

Identifying and recognizing common mistakes is the first step toward improving your trading proficiency. Here are some of the most frequent pitfalls that traders encounter:

- Failure to Conduct Proper Research: Many traders dive into markets without adequate research, leading to uninformed decisions. Always analyze trends, market news, and historical data before executing trades.

- Emotional Trading: Allowing emotions like fear and greed to dictate trading decisions can result in impulsive actions. Stick to your strategy and avoid sudden decisions based on market fluctuations.

- Ignoring Stop-Loss Orders: Not using stop-loss orders can expose traders to greater risks. Setting stop-loss orders can help limit potential losses and protect your capital.

- Over-Leveraging: Utilizing excessive leverage can amplify losses. Understand the risks associated with leverage and use it judiciously.

- Chasing Losses: Trying to recover losses by making risky trades often leads to further losses. Accept your losses and stick to your trading plan.

Psychological Barriers in Trading

The psychological aspect of trading is often overlooked, yet it plays a significant role in decision-making. Traders can face various psychological barriers that may cloud their judgment:

- Fear of Missing Out (FOMO): This feeling can lead to hasty trades; traders may buy assets at inflated prices. To combat FOMO, develop a well-defined trading strategy that you stick to.

- Loss Aversion: The fear of losing money can prevent traders from executing trades that are otherwise sound. Recognizing that losses are part of trading can help overcome this barrier.

- Overconfidence: Believing you’re invulnerable to market movements can lead to reckless trading. Stay grounded and continue learning, regardless of past successes.

Strategies for Maintaining Discipline and Emotional Control, Best Crypto Trading Strategies for Consistent Profit

Successful trading requires discipline and emotional control, essential for navigating the unpredictable crypto market. Here are some strategies to help:

- Develop a Trading Plan: A comprehensive trading plan should Artikel entry and exit strategies, risk management, and asset allocation. Adhering to this plan can help maintain focus.

- Set Realistic Goals: Establish achievable profit targets and don’t expect to become an overnight success. Focus on long-term growth instead of short-term gains.

- Practice Mindfulness: Incorporating mindfulness techniques can help reduce stress and improve focus. Techniques could include meditation or regular breaks during trading sessions.

- Review and Reflect: Regularly reviewing your trades and emotional responses can provide insights for future actions. Keeping a trading journal can aid in this reflection process.

Leveraging Trading Bots and Automation

In the fast-paced world of crypto trading, trading bots and automation tools have emerged as essential allies for traders seeking efficiency and consistency. These sophisticated programs allow traders to execute strategies with speed and precision, minimizing human error and emotional decision-making. Embracing automation not only streamlines trading operations but also opens up opportunities for profits that may not be achievable through manual trading alone.The use of trading bots can significantly enhance a trader’s ability to capitalize on market movements.

Bots can monitor the markets 24/7, executing trades based on pre-defined criteria without the need for constant human oversight. This not only allows traders to potentially capture profits during off-hours but also reduces the stress associated with making real-time trading decisions. Additionally, trading bots can implement complex strategies that may be challenging for human traders to manage effectively, such as high-frequency trading or arbitrage.

Benefits of Using Trading Bots

The advantages of incorporating trading bots into a trading strategy are numerous. Here are some key benefits:

- Speed: Trading bots can react to market changes in milliseconds, ensuring that traders can take advantage of fleeting opportunities.

- Consistency: Bots execute trades based on specific algorithms, eliminating emotional decision-making and allowing for a disciplined approach to trading.

- Backtesting: Many trading bots provide the ability to backtest strategies against historical data, enabling traders to refine their methods before deploying them in live markets.

- Diversification: Bots can manage multiple accounts and trades simultaneously, allowing traders to diversify their portfolios without the need for constant monitoring.

- 24/7 Trading: Automation allows for continuous trading, which is crucial in the cryptocurrency market that operates around the clock.

Selecting the Right Trading Bot

Choosing the appropriate trading bot is crucial for optimizing trading strategies. Factors to consider include:

- Compatibility: Ensure the bot can integrate with the cryptocurrency exchanges you intend to use.

- Features: Assess the bot’s features such as technical indicators, risk management tools, and customer support.

- User Reviews: Research user experiences and reviews to gauge the bot’s reliability and performance.

- Pricing: Compare the costs associated with different bots, including subscription fees and commission structures.

- Customizability: Look for bots that allow you to customize trading strategies to fit your specific needs.

Setting Up and Optimizing a Trading Bot

Setting up a trading bot involves several key steps to ensure optimal performance. Here’s a streamlined process:

- Research: Start by gathering information on various trading bots to find one that aligns with your trading style and goals.

- Configuration: Configure the bot according to your trading strategy, including setting parameters for entry and exit points, stop-loss orders, and take-profit levels.

- Backtesting: Test the bot with historical data to evaluate its performance and make necessary adjustments to your strategy.

- Live Testing: Begin with a small amount of capital to test the bot in live markets, monitoring its performance closely.

- Continuous Optimization: Regularly review the bot’s performance and adjust settings based on market changes and trading results.

“Trading bots can significantly enhance a trader’s efficiency and potential profitability, transforming the way crypto trading is approached.”

Staying Updated with Market Trends

Source: alamy.com

In the fast-paced world of cryptocurrency trading, staying informed about market trends is crucial for making informed decisions and maximizing profits. The crypto landscape is constantly evolving, and being in tune with market dynamics can help traders anticipate movements, identify opportunities, and navigate risks more effectively.Continuous learning and information gathering are fundamental components of a successful trading strategy. Here are some effective strategies and resources to help you keep up with current trends and shifts in the crypto market.

Resources for Market Updates

There are numerous platforms and resources available for traders to stay updated on market trends. Utilizing a mix of these resources can provide a comprehensive view of the market landscape.

- Podcasts: Crypto-focused podcasts can be an excellent source of insights and expert opinions. Shows like “Unchained” and “The Pomp Podcast” feature interviews with industry leaders and discussions on recent market developments.

- Newsletters: Subscribing to newsletters such as “CoinDesk” or “The Block” can deliver curated content directly to your inbox, highlighting important news and analysis on the crypto market.

- Forums and Community Groups: Engaging in platforms like Reddit’s r/CryptoCurrency or specialized Discord groups can provide real-time discussions and insights from fellow traders and enthusiasts.

The Role of Social Media

Social media has become an influential tool for gathering market intelligence in the crypto space. Many traders and analysts share valuable insights and breaking news through platforms like Twitter and Telegram.Contributing to the conversation on social media offers advantages such as:

- Access to Real-Time Information: Twitter accounts of prominent crypto analysts and news outlets often share updates about market trends, regulations, and technological advancements as they happen.

- Networking Opportunities: Engaging with other traders and influencers can provide access to unique perspectives and insights that may not be available through traditional media.

- Trend Analysis: Social media platforms can be monitored for trending topics and discussions, allowing traders to gauge market sentiment and reactions to various events.

“The best traders are the ones who are always learning and adapting to the market.”

By incorporating these strategies and resources into your daily routine, you can enhance your ability to stay informed and make more strategic trading decisions. The ever-changing nature of the crypto market demands that traders remain vigilant and proactive in seeking out information and insights to maintain a competitive edge.

Assessing Trading Performance

Evaluating your trading performance is essential for growth and improvement in the cryptocurrency market. Without a concrete method to track your trades, it’s easy to repeat mistakes or overlook successes. A systematic approach to performance assessment helps you understand what’s working and what needs adjustment.Tracking and evaluating trading performance involves keeping detailed records of each trade, including entry and exit points, profit or loss, and the strategies used.

This enables traders to identify patterns over time, whether they relate to specific strategies, market conditions, or personal emotional responses.

Template for Recording Trades

Creating a structured trade log is vital for effective performance assessment. Below is a simple template you can use to record your trades:

| Trade Date | Asset | Entry Price | Exit Price | Position Size | Profit/Loss | Strategy Used | Notes |

|---|---|---|---|---|---|---|---|

| YYYY-MM-DD | BTC/ETH | $XXX.XX | $YYY.YY | ZZ tokens | $AA.AA | Scalping/HODL | Your observations here |

This template allows you to capture all relevant information regarding your trades. Notably, the ‘Profit/Loss’ column helps you quickly gauge the effectiveness of your strategies.

Importance of Learning from Successes and Failures

Analyzing both winning and losing trades is crucial in refining your trading strategies. Each successful trade can provide insights into effective strategies, while failures highlight areas that need improvement. By reviewing these trades, you can identify consistent winning patterns or recurring mistakes.Consider maintaining a section in your trade log specifically for reflections. This could include what worked, what didn’t, and how you can adapt your approach in future trades.

“Success is not final, failure is not fatal: It is the courage to continue that counts.” – Winston S. Churchill

In summary, assessing your trading performance is not just about tracking profits and losses but understanding the underlying factors that contribute to them. This systematic evaluation is integral to becoming a more successful and informed trader in the ever-evolving cryptocurrency market.

Closure

In conclusion, the journey to mastering the Best Crypto Trading Strategies for Consistent Profit involves continuous learning and adaptation. By implementing sound strategies, managing risks effectively, and staying informed about market trends, traders can position themselves for greater success. Remember, the key is to develop a personalized trading plan that aligns with individual goals and regularly reassess it to navigate the dynamic nature of the crypto market.

Key Questions Answered

What is a crypto trading strategy?

A crypto trading strategy is a predefined set of rules and guidelines that traders use to make informed decisions in buying or selling cryptocurrencies.

How can I improve my trading performance?

Improving trading performance can be achieved by analyzing past trades, adjusting your strategy based on market conditions, and maintaining discipline in execution.

Is it necessary to use trading bots?

No, but trading bots can enhance efficiency by automating trades based on predefined criteria, allowing for quicker responses to market changes.

How often should I review my trading plan?

It’s advisable to review your trading plan regularly, ideally after significant market changes or at set intervals, to ensure it remains aligned with your goals.

What are common mistakes in crypto trading?

Common mistakes include emotional trading, neglecting to set stop-loss orders, and failing to conduct proper research before making trades.